Video Transcription:

The Biggest IPO Ever | Planet Finance - Optimized Transcription:

Three billion people in China, and I think one billion of them have used Alibaba. You look at a company like that in the United States, that company would be worth what Amazon's worth, but it is answering not to shareholders anymore; it's answering to another power. There's a million reasons why things don't happen in China, and we probably don't know one of those reasons. Well, I mean, you know, it's still the Forbidden Kingdom.

There is a world made up of numbers, a world where you have to be the smartest or the fastest, a world connected by radio waves and fiber optic cables, a world where you can make money if you think you know what the future holds. A world of fear and desire where you can win or lose. I call this world Planet Finance. Wandering around Planet Finance, I arrive at the most renowned of all financial markets: the stock market, in a place where you wouldn't immediately expect it.

Here in Shanghai on Friday nights, you can see a lot of online stock trading going on. The edge of the central People's Square turns into a trading floor. Everyone can share in the profits in a country that calls itself communist but that also seems very capitalist to me. China has opened its doors wide to Planet Finance as if the country has overcome its fear of capital flowing freely around the world. But now that the country is a contender to become one of the world's largest economies, I wonder who is going to set the rules of the game: China or Planet Finance?

The capitalism the way we have it structured works for us whereas China, they're thinking more on the whole as opposed to the individual. Anybody could learn from that. I'm not sure if I believe in any of the other stuff that goes on in China, but I think that believing in the whole and making sure the whole works is, you know, as far as business, I think that's a good model.

For years, Wall Street has been giving China plenty of room to make money on the international capital market. In recent years, the most valuable newcomers have mainly been Chinese. A good example is the large e-commerce company Alibaba, founded by the well-known Chinese entrepreneur Jack Ma. In 2014, he decides to list Alibaba not in China, but on Wall Street.

At the time of Alibaba's IPO, this trader was on the floor of the New York Stock Exchange as a direct eyewitness to this historic moment. For Jack Ma, bringing it to the United States was very important, knowing that the coverage you would get, the brand exposure, there's a lot of things going into it. But at the end of the day, I kind of think it was about ego too. I mean, it's very impressive to list your company, you know, build a company from scratch, you know, with 15 of your friends. The next thing you know, you're listing on the New York Stock Exchange. Thank you. If you want your company to grow, you go looking for capital. You can sell small portions of your company on the stock market. These shares can then be traded. The greater the demand, the higher the price. I've never heard of the company, and a friend of mine who worked on the trading floor said, "This is awesome because Alibaba is the most exciting company we've come across in our careers."

Everyone's looking at it and saying, "Well, this is the same thing as Amazon because it's a very similar business model." And the investors are jumping over each other because they feel this is their chance to invest in the Chinese miracle. In 2014, Western investors, such as our pension funds, are licking their lips at Alibaba's IPO and the company's potential for growth. Again, we have probably about 350 reporters outside. They may be yelling, they may be screaming. This is just part of it. Jack will ring the bell, and then the first day is where all the action is. And you know, people were jumping over each other to try to get shares. It's the largest IPO in history. Certainly, this is a big deal. This is a global deal. This is, by far, the biggest IPO event extravaganza that we've had down here. I would say probably since I've been down here. It's basically the purest example of a functioning market. It has supply, it has demand. Supply meets demand, demand meets supply. And that's all it is. It's stressful in the fact that you've got to be there, you've got to listen, and there's the craziness of an IPO.

Meanwhile, I have Jack Ma, and I started talking to him. I congratulated him and everything, and he was, you know, talking. He goes, "This is so exciting." You know, it was like he was thrilled. And I told him, I said, "Well, let me show you what I'm doing on my handheld. So this way, you have an idea." And I was like, maybe four and a half million shares to sell and maybe two million to buy. And I said, "These are the smart guys. So I made them feel good. All the buyers, the blacker, those smart guys, and the guys in red, they're not so smart." He was dying laughing. Of course, Jack Ma is laughing. The demand is much, much higher than the supply. And so on the day of the IPO, the Alibaba share price immediately goes up.

But not all the shares are put up for sale. A large portion remains under the ownership of Jack Ma and a select group of early investors. They hit the jackpot. That day, he became -- I mean, on paper. Everything is on paper, no matter what. Any gain is on paper until you sell it. But I believe it was 15 or 18 billion dollars. Billion. Yeah. So, I mean, I could be 100% wrong about that. You could look it up, but I think it was roughly about 15 or 18 billion dollars, give or take a billion. Um, so he was a very happy man. That makes Alibaba's IPO the biggest one ever. The dollars flow into China, and the doors are open wide for Planet Finance.

Fast forward six years, Jack Ma is the richest entrepreneur in China, but he still can't resist the urge to score it big again. Now he wants to take his fintech company and group public, but this time, he doesn't choose New York. Should have been the biggest one ever again, but things didn't work out as planned. To understand how the IPO put the relationship between China and Planet Finance on edge, I'm taking you to Hong Kong. For a long time, this was Asia's main financial center and an outpost of Western capital. And this time again, Western investors are first in line for Ant Group's IPO because in China, the entire country has become dependent on the financial super app Alipay, developed by Ant Group. It shows her unique Alipay code and has it scanned. Done. All the names.

There are so many other functions to explore because with this app, you can make payments, but also take out a loan or insurance, save money, and even trade. This fund manager clearly sees the potential of the IPO as well as always, he is looking for returns also on our pension

money so he is assessing at what price he would want to get on board really Sensational yeah so thanks a lot for that and uh let's make Arnold van rein has worked in Hong Kong for years and shares his considerations with me in the run-up to the IPO and due to the pandemic he does so at a distance.

I hope it's more than 200 billion actually it is but there is no Planet Finance without small investors even this taxi driver wants to get a piece of the pie. By buying shares in Ant Group, our taxi driver gets himself a wafer thin slice of the Pie as a co-owner of the company and with a little bit of luck the IPO is such a big success that he can make a huge profit. Me in order to even qualify for Ant Group shares everyone has to sign up through a special app nine days before the IPO.

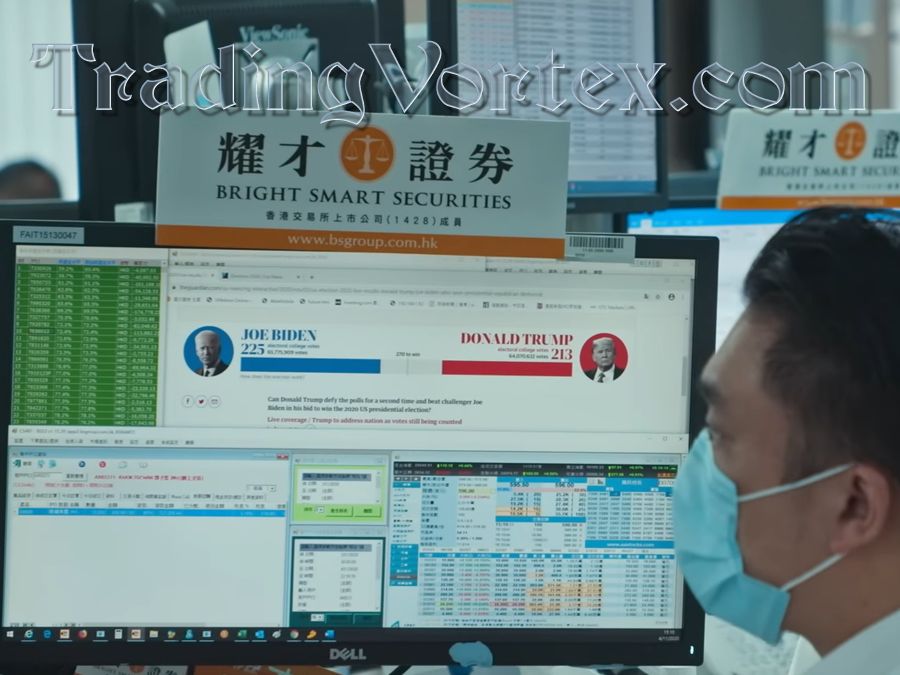

A dual listing that doesn't happen very often often in Shanghai and same time in Hong Kong why does Jack ma want to do this on both sides because China has built a virtual wall between mainland China and the rest of the world this wall is supposed to protect the Chinese market from outside influences but it mainly has to make sure that Chinese Capital stays within the nation's borders in Hong Kong Jack Ma can raise international capital and in Shanghai he gains access to the piggy banks of the new Chinese middle class by day these new investors are shown their way around Planet Finance by this wealth manager but at night he becomes a so-called influencer through his Tick Tock account Liu ping keeps his millions of followers informed of the Market's ups and downs and I can join him for a session. Thank you. Meanwhile, our taxi driver is eagerly awaiting things to come along. [Music] ER of 50 000 shares of a total 368 million shares that Ant Group will bring onto the market. It still remains to be seen whether he will actually get these shares because he's not the only one in Hong Kong. One out of five inhabitants sign up for Ant Group's IPO and for small investors the only way to do that is through a so-called broker. The broker's clients are at his office doing trades as if it were a casino they are speculating to earn as much as 10 cents of profit per share. With their margin account these Fortune Seekers can greatly increase their chances with all the risks involved. So they can sign up for a much higher number of shares than they can afford which only increases the demand for Ant Group shares. Our taxi driver has also put himself in debt this way his 50 000 shares amount to half a million euros and all of that only to be able to play the game on planet Finance.

The hype around the IPO reaches great heights in Hong Kong, where demand is now nearly 400 times higher than the available shares. This intensifies the game of supply and demand, raising questions about the share price. This psychological game is what Planet Finance thrives on because ultimately, the value of something is what someone is willing to pay for it. This reality unnerves Beijing, which, given its history, is wary of the risks associated with participating in global financial markets.

In the days of Mao, stock markets didn't exist in China, making its foray into Planet Finance relatively new and risky. Against this backdrop, individuals like Liu Ping, who have pulled themselves out of deep poverty, face the prospect of potentially losing everything once again.

Meanwhile, Jack Ma's warning about Chinese government power and his subsequent speeches further unsettle the Chinese financial elite. Three days before the planned IPO, this unease crescendos, leading to Beijing's decision to halt Ant Group's IPO, the largest ever, just days before its listing.

The abrupt cancellation leaves everyone stunned, with Beijing rendering Planet Finance speechless. Brokers, wealth managers, and ordinary investors grapple with the sudden turn of events, realizing that what seemed too good to be true indeed was. Jack Ma's disappearance adds to the mystery surrounding the situation, leaving speculation about his future and the fate of Ant Group.

In the aftermath, Beijing imposes stricter regulations on Chinese tech companies, signaling its intent to assert control over its large tech sector. This move rattles Wall Street and prompts questions about Beijing's motives and the future of Chinese tech giants. Ultimately, Beijing's actions underscore its determination to set the rules of engagement on Planet Finance, reshaping the landscape for future IPOs and financial dealings.

Throughout these developments, the documentary reflects on the implications of Beijing's intervention, highlighting the evolving dynamics between China and the global financial system.

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.