Unveiling the Shadows: Exploring the World of Tax Avoidance in “The Tax Free Tour”

In an era of increasing global interconnectivity and economic integration, the issue of tax avoidance has emerged as a contentious and complex matter. In 2013, the VPRO documentary “The Tax Free Tour” shed light on the practices employed by multinational corporations to navigate the labyrinthine world of tax loopholes and offshore havens, enabling them to minimize their tax obligations. This thought-provoking documentary took viewers on an eye-opening journey, revealing the inner workings of a system where profit shifting and elaborate tax schemes have far-reaching consequences for economies worldwide.

“The Tax Free Tour” transcended mere exposé, serving as a wake-up call to society about the magnitude and implications of corporate tax avoidance. By delving deep into the mechanisms and strategies employed by these entities, the documentary aimed to demystify the intricate web woven by those seeking to exploit tax loopholes to their advantage. It presented a stark contrast between the tax burdens shouldered by individuals and small businesses, and the methods employed by multinational corporations to reduce their tax liabilities, often resulting in billions of dollars in lost revenue for governments.

Through insightful interviews with economists, tax experts, and investigative journalists, “The Tax Free Tour” underscored the wider repercussions of tax avoidance. It examined the erosion of public trust in the fairness and effectiveness of taxation systems, the exacerbation of income inequality, and the strain placed on public services due to diminished tax revenues. Furthermore, the documentary highlighted the role of tax havens as facilitators of these practices, exploring the ethical and legal implications of jurisdictions that offer secrecy and leniency to attract multinational corporations seeking to avoid their fiscal responsibilities.

As we delve into the world unveiled by “The Tax Free Tour,” it becomes evident that this documentary serves as a crucial catalyst for broader discussions and reforms in tax policies and global economic governance. By understanding the tactics employed by corporations and their impact on society, we can begin to address the root causes of tax avoidance and strive for a fairer, more transparent, and sustainable system.

Video Key Points:

- The idea of a tax-free world where laws and regulations can be adjusted according to individual preferences is discussed.

- The concept of "neutral taxation" is introduced, referring to a world without taxes.

- Money is found to be parked in offshore havens, indicating a significant role in tax avoidance.

- The case of Apple is used as an example: They sell iPads for $10 billion in China, but only a fraction of the profits stays in China, with a large portion being shifted offshore to low-tax havens.

- Apple's effective tax rate is highlighted, with them paying only 1.9% corporate tax rate in the United States despite the country's 35% effective tax rate.

- The flexibility of rules and the difference between tax evasion and avoidance are mentioned, emphasizing the complexity of higher-level tax strategies.

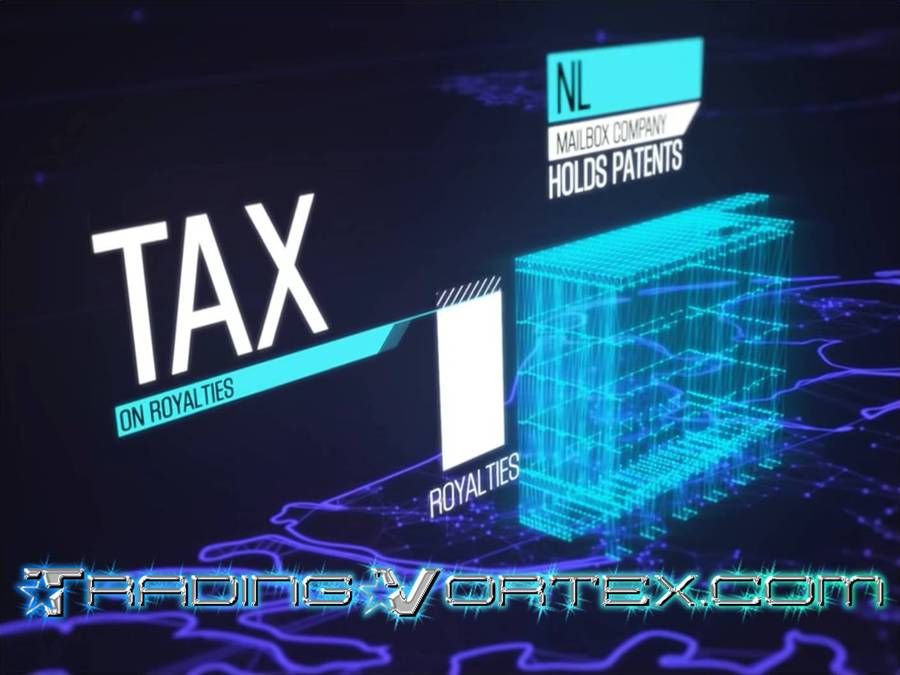

- The existence of an offshore world is described, where multinational companies structure their capital flows and utilize tax havens to minimize tax obligations.

- The role of a corporate investigator is explained, involving the examination of offshore structures and tax haven usage by companies.

- Complex and mysterious chains of ownership and offshore transactions, such as the "Cyprus sandwich" example, are mentioned.

- Lack of transparency and clarity in offshore financial activities is highlighted.

- The introduction of business intelligence investigator William Brittan Catlin, who specializes in analyzing global capital flows and the shadow side of financial transactions.

- Multinational companies operating in Africa structure their accounts to minimize tax payments.

- Companies exploit loopholes and establish subsidiaries in tax havens to pay as little tax as possible.

- Kenya has special economic zones that serve as formal methods of tax avoidance.

- Companies in Kenya initially receive a 10-year tax break, but many close or change ownership after the tax break to exploit the system.

- Secret tax arrangements in African countries fail to deliver promised benefits and lead to exploitation of resources without significant long-term benefits.

- Multinational companies evading taxes shift the burden onto citizens through regressive taxation systems like value-added taxes (VAT).

- Tax competition among countries leads to a race to the bottom with minimal corporate tax rates, hindering growth and causing money to flow out of countries.

- Multinational companies transfer intellectual property to tax havens to reduce tax liabilities.

- Companies like Apple, Pfizer, and Starbucks engage in secret arrangements with tax authorities to minimize tax burdens.

- Starbucks faced scrutiny for its low tax payments in a hearing before an English parliamentary committee.

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.