Market Mayhem: Unraveling the Flash Crash Phenomenon.

“Flash Crash 2010” is a thrilling and meticulously researched documentary that takes viewers deep into the heart of our automated world, exploring the events surrounding the fastest and deepest U.S. stock market plunge ever recorded on May 6, 2010. Drawing on interviews with individuals directly involved and utilizing cutting-edge data visualizations up to the millisecond, this documentary offers a gripping and immersive experience that sheds light on the inner workings of the financial industry.

With its foundation in actual events, "Flash Crash 2010" intertwines a captivating narrative with real-life interviews to provide an authentic and gripping account of the flash crash. The documentary takes viewers behind the scenes, revealing the intricate web of technology, algorithms, and high-frequency trading that underpins modern financial markets.

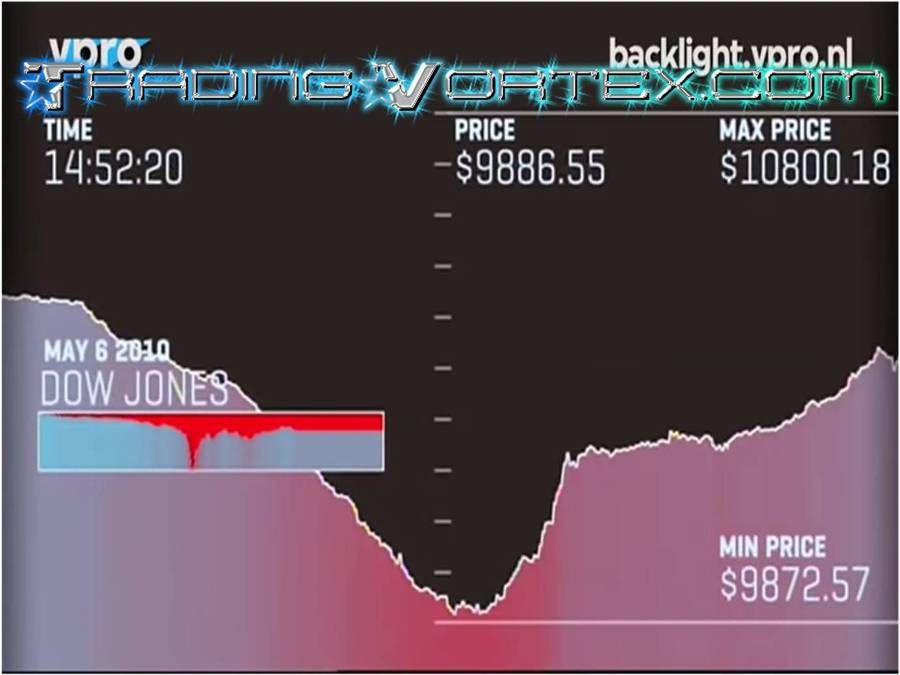

Through meticulous data visualizations, viewers witness the rapid and unprecedented decline that sent shockwaves throughout the financial world. The documentary captures the intensity and complexity of the events, showcasing the speed at which the crash unfolded and the subsequent ripple effects on global markets.

Incorporating firsthand accounts from those directly involved, "Flash Crash 2010" offers unique insights into the motivations, actions, and consequences of key market participants. Viewers gain a deeper understanding of the role played by automated trading systems, algorithms, and the interconnectedness of global markets.

The documentary goes beyond a mere retelling of events, delving into the underlying factors that contributed to the flash crash. It explores the vulnerabilities inherent in an increasingly automated and interconnected financial landscape, raising thought-provoking questions about the risks, ethics, and regulatory challenges associated with modern trading practices.

With its thrilling narrative, gripping visuals, and meticulously researched content, "Flash Crash 2010" offers an engaging and eye-opening exploration of the flash crash that rocked the U.S. stock market. It provides a nuanced understanding of the forces at play and serves as a cautionary tale about the potential pitfalls and complexities of our automated world.

Video Key Points:

- On May 6th, 2010, the US stock market experienced a significant decline known as the flash crash.

- The flash crash occurred at 1400 hours and 42 minutes and was the fastest and most significant decline in the history of the Dow Jones.

- Traders and investors were taken by surprise, with some individuals being on holiday or engaged in other activities at the time.

- The market fell by almost a thousand points within minutes, causing panic and confusion.

- Rumors circulated, and the market continued to decline, leaving many people astonished.

- The sudden market movement appeared unexplainable initially, resembling an error rather than a response to a global news event.

- The market quickly recovered from the decline, raising questions about the reliability of automated trading systems.

- The flash crash highlighted the increasing reliance on automated trading algorithms, known as black boxes.

- These algorithms, operated by famous banks, made trading decisions based on complex rules and calculations.

- The workings of these algorithms remained concealed, leaving experts puzzled about the extreme market fluctuations.

- High-frequency trading and automated financial markets have become the norm, with trades executed within milliseconds.

- Individual investors find it challenging to react quickly due to the speed advantage of high-frequency traders.

- Wealth generated by automated systems primarily benefits the machines, while neighboring communities often face economic struggles.

- Infrastructure, including data centers near financial centers, plays a critical role in ensuring uninterrupted trading operations.

- High-frequency traders, estimated to generate more than half of the equity trade volume in the US, capitalize on their speed advantage.

- The flash crash exposed the vulnerabilities and complexities of automated financial markets.

- While the advantages of speed and efficiency are evident, the consequences and potential risks of relying heavily on automated trading systems are still debated.

- There are concerns about being behind and not knowing the extent of the delay before the SEC report.

- Eric on Sader published findings on his website about the delay.

- The SEC report dismissed the delay as insignificant, but it matters to clients and affects everyone.

- Faster data access is crucial in the financial industry.

- A requirement for connecting to financial institutions is having a thousand-foot cable, regardless of proximity.

- Latency is negligible, but it does affect trading speed.

- Financial institutions using direct data links receive price information without delays.

- The NASDAQ exchange is mentioned, and the construction and security details are discussed.

- Hedge funds and banks can profit from market volatility by exploiting price discrepancies.

- Opportunities exist where buying low and selling high can yield substantial profits.

- Price differences between exchanges can be exploited for risk-free gains.

- Arbitrageurs take advantage of system malfunctions and make money by being faster and closer to the exchange.

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.