Scalping is not easy for beginners; please try the system at least one month on your demo account before starting on live account.

Why Scalping Strategy Using Price Action can be very useful?

All of us wish to make speedy cash with Forex. There are a hundred’s of scalping trading strategies in foreign exchange, however 99,9% of them do no longer work or are simply very hard to observe.

The purpose of scalping is to make small earnings while exposing a trading account to a very restrained risk, that's due to a quick open/close trading mode. There wouldn’t be any point in scalping for plenty traders if they weren’t allowed to trade with highly leveraged accounts. Only the capacity to perform with big budget of, certainly, still virtual cash, empowers investors to profit from only a 2-3 pip move.

Due to signal delays, lagging etc., scalping strategies using mt4 (Metatrader 4) indicators can sometimes be very complicated. In this situation, using a price action scalping system, that uses no indicators, can be far more profitable. The price is going to tell you what to do. The price will be itself the signal to follow and in the same time your favorite indicator.

How to earn stable income using Price Action Trading Strategy?

This strategy of trading uses 4 different time screens; it is a Forex technique without indicators. It offers a good possibility of profit, with proper risk management, as well as a stable income potential.

This universal strategy can be used both for a very short scalping trading session and a regular day trading. We will share both methods for scalping and normal day trading: when placing orders, taking profit and setting a stop loss.

This technique is based on a 4 time frames screen system: M5, M15, M30 and H1 time frames, and uses protective stop orders including: a trailing stop, a stop loss as well as take profit levels.

To use this strategy, all you have to do is open four different timeframe windows with the desired currency pair (like: EUR / USD for example). You should select H1, M5, M15 and M30, in your trading terminal (for example: Metatrader 4). If you select "Vertical" in the Metatrader 4 "Window" menu, the four screens will be placed in order in adjacent windows like in the example below.

Based on a strong current trend confirmation entry signal, the "Price Action Scalping strategy" is very easy to use on your trading terminal and you will get one signal an hour (almost every hour).

You don't have to sit down and watch the market all the time to use this technique, just get ready at the last minute of the present hour, if there's a signal: place a trade, if not: you're free for the next 59 minutes until the next trading opportunity.

If you want more opportunities, you can simultaneously open more charts (for example you can open 5 or 6 currency pairs, 4 time frames each). Convenient and easy!

BUY entry Signal:

BUY Entry Signal Check List:

- Wait for the closing of the current hour candle.

- If all 4 of the last candles (M5, M15, M30 and 1H) are closed in green.

- Wait for the price to go 3 more pipes above the closing and place a BUY order immediately.

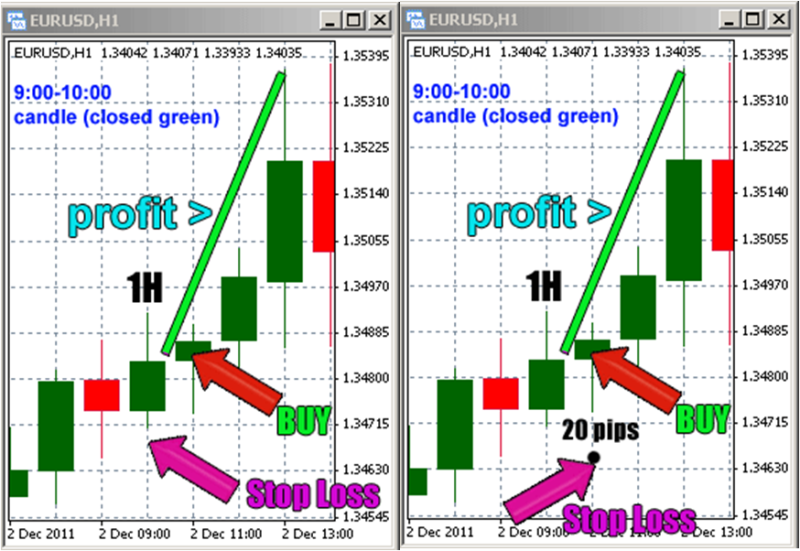

BUY Entry Signal Example: From the above screenshot.

If all the conditions below have been met, you can immediately place a BUY order at the market price.

- A 9:00 candlestick closed green at 10:00 on 1H chart.

- On the M30 chart, a 9:30 green candlestick closed at 10 a.m.

- On the M15 chart, a 9:45 candlestick closed green at 10:00 a.m.

- On the M5 chart–a 9:55 candlestick closed green at 10:00 a.m.

- Wait for a 3 further pipes above the closing price before taking position.

Waiting until the price moves another 3 pipes above the last closing candlestick is very important ➳ it's your double confirmed entry signal.

If in the first 5 minutes of the current hour the price does not break the 3 pipes of your entry level ➳ do not enter a trade! Just wait at the start of the next hour for better trading opportunity!

If you prefer using the system as a scalper, be sure to keep your take profit and stop loss orders very tight.

SELL entry Signal:

SELL Entry Signal Check List:

- Wait for the closing of the current hour candle.

- If all 4 of the last candles (M5, M15, M30 and 1H) are closed in RED.

- Wait for the price to go 3 more pipes below the closing level and place a SELL order immediately.

For example: If all the conditions below have been met, you can immediately place a SELL order at the market price.

- On the 1H chart - a 10:00 a.m. candlestick closed red at 11:00 a.m.

- On the M30 chart - a 10:30 candlestick closed red at 11:00 a.m.

- On the M15 chart - a 10:45 candlestick closed red at 11:00 a.m.

- On the M5 chart - a 10:55 candlestick closed red at 11:00 a.m.

- Wait for a 3 further pipes below the closing price before taking position.

Waiting until the price moves another 3 pipes below the last closing candlestick is very important ➳ it's your double confirmed entry signal.

If in the first 5 minutes of the current hour the price does not break the 3 pipes of your entry level ➳ do not enter a trade! Just wait at the start of the next hour for better trading opportunity!

How to set your STOP LOSS for this Forex Trading Strategy?

1. Place a fixed stop loss for a buy trade at 2 pips below the low of the earlier 1-hour candlestick or 2 pips above the high of the past 1-hour candlestick for selling position.

2. Place a fixed stop loss at 20 pips below (for Buy trades) or above (for Sell trades) away from your entry point.

The stop loss is transferred to breakeven when the price reaches 15 pips. You can resort to the trailing stop depending on your trading preferences.

3. Place your stop-loss order close to major highs / lows = strong support and resistance levels.

This Price Action Scalping strategy can only be profitable by strict adherence to these rules.

See examples below:

How to set your TAKE PROFIT for this Forex Trading Strategy?

Set your take-profit 30 to 40 pips away from your entry level.

Always have in mind that the selected Take-profit should always be 2 to 3 times bigger than the stop-loss.

Important recommendations for this system!

Do not trade right before, during or immediately after major news releases.

I recommend using this strategy simultaneously on 5 to 6 major pairs.

To do that, you will have to open 4 charts for each pair: M5, M15, M30 and 1H.

This setup will give you a lot of signals every day which will be profitable for 75 to 80 percent of time.

More Tips for newer Forex scalpers!

1. Always make sure your broker allows you to use Scalping Strategies:

This is the first and most important thing you need to do in Forex scalping.Calling and asking people on the chat if scalping Forex was allowed isn't the solution, because they all said that it was. Call and ask your broker, it well worth it. You should speak to a manager or someone important.

2. Get the most out of your profitable trades:

Have you ever heard of the expression, "There is power in numbers?" Well, it's a scientific fact that has been demonstrated repeatedly. Make sure you're getting a high amount when you scalp a pair. This is to increase your profits. So if you make 2 pips in your trade, you can make a good couple hundred to a few thousand dollars.

3. You must accept your losses:

This will probably be one of the most important tips ever. You can and will most likely encounter a few losses on your Forex scalping journey, together with several quick profits. This is why these losses must be accepted.

4. Set a good plan before you start Scalping the Forex market:

During your trading journey, this is the best way to avoid unexpected hi-losses and bad surprises. The demo account allows you to trade in a real time conditions while trying out different pairs at the same time. This can greatly improve your chances to increase quickly your skill. Use your demo account until you find a combination of pairs that you like.

Imagine that your demo account is your real money. Imagine taking a significant loss when you make an error, in real life. Even after a big loss, if you feel completely relaxed with all that, you're ready to trade on real account.

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.