Table of Contents:

- Strategy #1: How To Avoid Being 'Washed And Rinsed' When Trading?

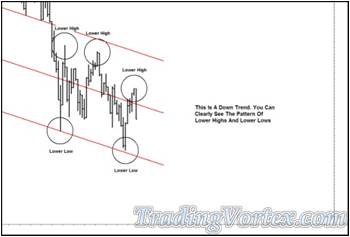

- Strategy #2: How To Become an Expert at Reading Price Movement?

- Strategy #3: How A Professional E-Mini Trader Finds Great Trades?

- Strategy #4: Stalking Major Moves: How To See Signs of Where the Market is Headed?

- Strategy #5: How A Professional Trader Builds a Case For Entering a Trade?

- Strategy #6: How To Train Your Eyes To See Charts Like a Pro?

- Strategy #7: How I Stalk My Trades To Find Good Entries?

- Strategy #8: Using Simple Box Formations For Big Trading Profits.

- Strategy #9: Reading Gaps in Charts to Find Good Trades.

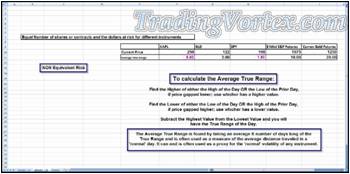

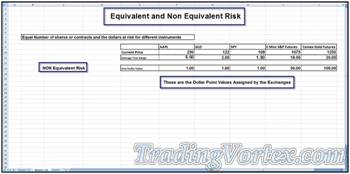

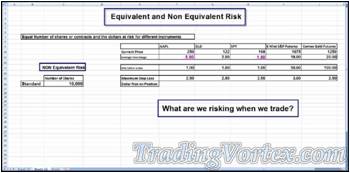

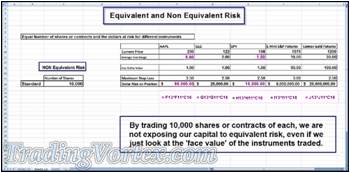

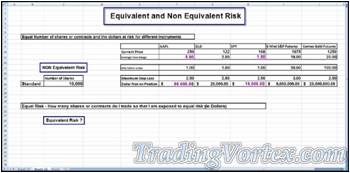

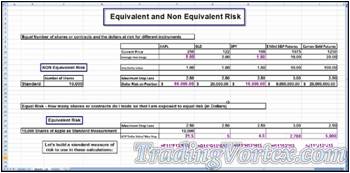

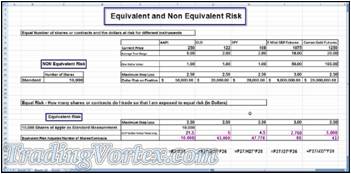

- Strategy #10: The Ultimate Risk Management Tool: Equivalent Risk.

- Strategy #11: Improving Your Skills at Predicting Market Behavior.

- Strategy #12: How To “See” The True Message of the Markets?

- Strategy #13: How To Remain Confident Even in Uncertain Markets?

- Strategy #14: Taking Quick Profits vs Letting it Run: “Bread and Butter” or “Bread Crumbs”?

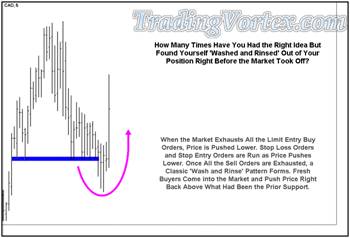

How To Avoid Being 'Washed And Rinsed' When Trading?

How many times has this happened to you? You waited patiently for the market to show you where it’s going, then bought or sold the breakout to new highs or lows, only to be stopped out when price pulls back against the new trend. And of course, once you were stopped out of the market, the market returned to the trend "Without You!"

Or maybe you waited patiently for price to approach a prior area of support; then you got long at that support area. Once you were in the market, price briefly violated the support area, stopping you out of your position. And of course, once you are stopped out of the market, the market climbed back above the support and headed higher "Without You!"

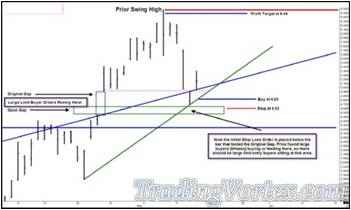

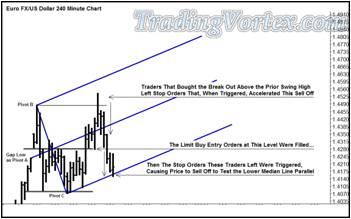

You were just "Washed and Rinsed", which is a classic trading term for being stopped out of your position on a minor pullback against the trend. Let’s look at a chart showing a classic ‘wash and rinse’ pattern:

Click on the image to open the full size version!

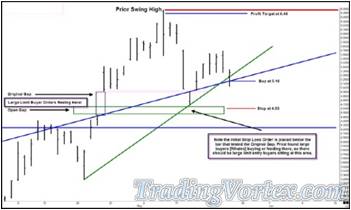

The traditional method for buying at prior support would be a limit buy order at the test of the prior multiple bottoms marked by the blue trend line and then putting a stop loss order below the trend line. You can see this method would have resulted in you entering a long position and then quickly getting stopped out as price briefly plunged through the trend line area.

When prices began to trade below the trend line marking the multiple lows, breakout traders began selling ‘at the market’ to enter new short positions. These new entry orders pushed the market lower, executing stop loss orders left by the traders that had been getting long against the support marked by the trend line. But note that once the breakout traders’ orders and the stop loss orders ran their course, price pulled right back above the trend line and headed higher "as the new short positions entered on the break below the trend line began to be stopped out!"

Getting ‘Washed and Rinsed’ is a common occurrence in trading. Is there a way you can avoid it?

I have been working with my students in one on one mentoring with a pattern we call the ‘Lazy Z’ that was designed to help avoid being ‘washed and rinsed’ when attempting to enter trades at these critical areas. Let’s look at some charts and see if I can explain how we use this ‘Lazy Z’ pattern to help avoid being ‘washed and rinsed’.

Click on the image to open the full size version!

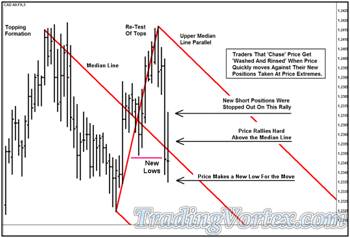

Price just ran through an area where it should have slowed or even stopped and reversed: The red down sloping Median Line. In the past, traders that use Median Lines would look to sell a re-test of this down sloping line as price pulled back to it from below.

But looking at the statistics of trading this pattern over the past three years, it has become obvious that many times, this first breakthrough and subsequent pullback is often a trap.

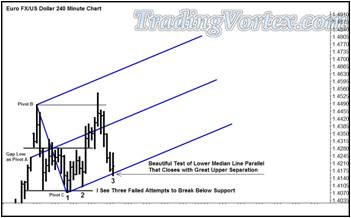

Let’s look at another chart and see why traders are finding themselves stopped out of their positions in this situation:

Click on the image to open the full size version!

As price makes new lows for the move, it ‘zooms’ or runs through and closes below the Median Line. When price makes new lows, breakout traders establish now short positions by selling ‘at the market’ and at this point, these new positions have very little profit in them.

Once the selling has dried up, price begins to pull back and many of stop loss buy orders, left by breakout traders above where they entered their short positions, are now being filled driving the market higher. The rally after the new lows runs higher until all the stop loss orders are filled; then price settles back lower, making a marginal new low for the move.

Click on the image to open the full size version!

The price has now closed below the Median Line three bars in a row but it is making no progress to the downside. The traditional Median Line entry method would have been to sell a re-test of the Median Line as price re-tested it from below, but as I noted earlier, we have noticed that this entry setup has been degrading in quality over the past 18-36 months.

Also note that if you chose to sell a re-test of the Median Line as price approached it from below, there was no logical place to hide a stop behind prior swing highs.

Click on the image to open the full size version!

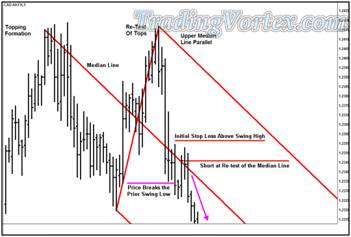

Description Of ‘Lazy Z Pattern’:

Here’s a look at the pattern we have been testing, the ‘Lazy Z’ pattern:

- Price makes a new low for the move, zooming through a Median Line or a trend line.

- Because new short positions were taken by the breakout traders, a ‘wash and rinse’ rally ensues, shaking out the ‘weak’ short positions.

- Once the new weak short positions are ‘washed’ out of the market, price goes on to make new lows for the move.

Lazy Z Pattern Quality Analysis:

- Price makes a new low for the move, breaking below a trend line or Median Line. In this move lower, breakout traders enter new short positions when price breaks below the prior low.

- A short covering rally ensues, as the new weak short positions get ‘washed’ out of the market. This rally ends as soon as all the stop loss buy orders are filled.

- The short covering rally leaves a ‘pseudo’ swing high that is above the trend line or Median Line, but near enough to the current action to be useful when attempting to hide stop loss orders.

- Fresh sell orders enter the market and push it to new lows again. This second wave of selling confirms that there are new sellers available to push prices lower, in effect, the second low confirms that the trend is likely to continue. When a new low for the move is made, it confirms the ‘pseudo’ swing high as a true swing high, and there will now be limit sell entry order at or near that new swing high that you can use to protect any short positions you initiate.

- Now you can enter a sell order at the re-test of the trend line or Median Line in case price approaches it from below. If filled, your stop loss order will be above the recently formed swing high.

Now that I have drawn it all out and described it, let’s see how the market behaves:

Click on the image to open the full size version!

Price makes a wide range bar lower. Note that it leaves a higher high and a lower low! This bar marks a new low for the move and the high of this bar is now a ‘pseudo’ swing high.

I place orders to sell a re-test of the red down sloping Median Line. I price rallies to the Median Line from below, I want to enter a short position and my stop loss order will be above the new ‘pseudo’ swing high.

Click on the image to open the full size version!

Price makes a new low for the move, confirming the ‘pseudo’ swing high as a true swing high and then rallies to test the Median Line. I get short at test of the Median Line and my stop loss order is above the new swing high, where there should be limit entry sell orders left by traders looking to enter new short positions. These orders should act as protection and help keep me from being ‘washed and rinsed’.

Price rallies a bit higher but then the selloff begins again. Note that my stop loss order was never in danger. Now I can focus on managing the potential profits in this trade as price continues to make new lows.

Click on the image to open the full size version!

‘Lazy Z’ entry technique used on a trend line:

Click on the image to open the full size version!

You can see that price has tested this trend line many times and each time, the trend line held and a new rally was spawned. But if you look carefully, there were at least four occasions where selling new lows led to getting ‘washed and rinsed’ out of a short position. If you had tried to sell new lows four times and gotten stopped out four times, would you have been able to sell the fifth break to new lows? Would you have been able to sell the sixth break to new lows?

Rather than sell blindly selling new lows, smarter traders have started waiting for a pullback to sell: they have learned that ‘what was resistance has become support’ and are trying to exploit it. But even this method has become susceptible to the ‘wash and rinse’ pattern.

- I suggest you don’t sell new lows or buy new highs: there are too many false breakouts and most of us are not equipped emotionally or financially to be there for the fifth or sixth or seventh breakout if we have sold and been stopped out of the prior four false breakouts.

- I also suggest you consider revising your trading entry that includes selling when price pulls back to the resistance [which had been support].

- I suggest you consider looking at the ‘Lazy Z’ pattern. Make certain there is a fresh steady stream of sellers by sitting on the sidelines until price makes a ‘wash and rinse’ rally, then makes a fresh new low, and THEN enter your limit sell order with a stop loss order above swing high just made when the weak short positions were forced to cover.

- You will have found confirmation that there are fresh sellers and now you’ll have a swing high to hide your stop loss order above, ensuring some protection from limit sell entry orders.

- The markets change and evolve. If we don’t do our homework and adapt accordingly, our trading profits will suffer and eventually disappear.

How To Become an Expert at Reading Price Movement?

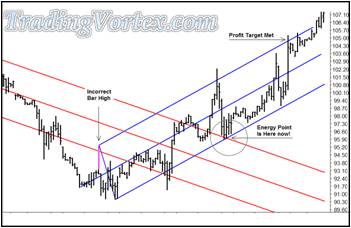

Besides being a professional trader for the past 37 years, I have the privilege of mentoring some wonderful traders of varying degrees of experience. I happen to mentor a pair of gentlemen that run their own very successful CTA and besides working with them on Median Lines, I have also helped them really master the concept of using structures in the market as areas to hide your stops. They have also seen the importance of my innovation, Energy Points [or areas where lines of opposing force meet], and use this concept successfully in their trading.

Recently, we were both stalking the same market on the same time frame, the Crude Oil futures. Crude Oil futures are notoriously volatile and obviously have become more so in the past 2-3 years. There are many times when you see a bar unfold and look at it in disbelief, certain that the bar extreme range of the bar was caused by an incorrect price that will later be corrected by the exchanges; sometimes you are right and it was an incorrect price and sometimes you are wrong and it is a wild wide range price bar. But there is NO way to tell as each tick unfolds. Perhaps the exchange transmitted the wrong price, perhaps your computer got disconnected from the price server for a moment and that caused a corrupt data point or perhaps the price was real.

I recently spoke at the Forex Expo in Las Vegas and one of the reasons many of the panelists [including myself] gave as a reason they liked the data delivered from the exchanges better than the data delivered in the Cash FX market data feeds, for example, is that it is cleaner, more reliable and every single transaction is recorded and transmitted in the order it was executed; in the Cash FX market, there are at least fifteen different ‘major’ data feeds and if you look at their data, you’ll see they all have different daily highs and lows, the highs and lows of each of the bars are slightly different from feed to feed, in short, while they represent the market, they are not an accurate tick by tick picture of the market. When you compare them to the electronic contract feeds from the exchanges, the difference is night and day. But there is a dirty little secret here: in ‘real time’, even the exchanges sometimes transmit ticks that are incorrect, although they do go back and re-transmit the correct data. IF your charting package reloads historical data automatically and or allows the exchanges to refresh tick historical data, you’ll probably never notice any errors unless they are blatantly out of the current range.

The Crude Oil Trade Example:

Let’s take a look at a gorgeous trade in the crude oil that two of the gentlemen I mentor and I took in the Crude Oil futures market.

Click on the image to open the full size version!

Looking at the chart above, you can see that price was in a steep down trend and then after a very wide range bar, began to make higher highs and higher lows, a sign of a change in behavior. This made all three of us start stalking a potential long set up in the Crude Oil Market, since it had fallen more than $50 per barrel from its highs.

Our eyes were drawn to several Energy Points above the market and we monitored each one, looking for a high probability trade set up with an acceptable initial stop loss to enter a long position. You can see that price got dragged to the Energy Points [a key attribute of Energy Points] and then finally at the sixth Energy Point, we saw what we were looking for: A high probability trade set up that I teach and trade all the time [in this case, a test and re-test] with an acceptable initial stop loss order area that was hidden below market structure. Hiding our stops UNDER market structure is key, because other traders will have limit buy orders near or at that market structure [in this case, a prior swing low] and their limit buy orders will act as protection for our stop loss orders.

In this trade, we wanted to get long Crude Oil futures at 96.37 with an initial stop loss at 95.63, hidden underneath a prior swing low where other traders were leaving limit buy orders. Our profit order would be at the Upper Median Line Parallel, which initially came in at 102.29. We were risking 74 cents per barrel to make a potential 5 dollars and 92 cents, giving us an initial risk reward ratio of 8:1. And as time moved price to the right on the chart, the profit target and our potential profits would go higher.

We checked our orders and put them in the market and our entries were filled on the next bar. You can see our position was never in any danger of being stopped out after the second bar closed and then we simply had to manage the stop profit and limit sell orders as price unfolded. As I say over and over, you spend the majority of your time when trading doing the tedious work: moving orders, checking details, and waiting, waiting, waiting.

Price finally met the Upper Median Line and took us out above 105 a barrel and we obviously made a great deal of money per contract on this trade.

But there’s a problem: While this trade unfolded on the charting package we were using exactly as you see on this chart, if you look carefully before price turned higher, I marked a wide range bar with the term ‘Incorrect Bar High’. In reality, the high of this bar was nowhere near as high as initially reported by the exchange. In fact, the high of this bar was actually about THREE dollars per barrel lower than it was initially reported. It’s difficult to know what caused the initial tick to be reported that high: It may have been a glitch at the exchange, it may have been a glitch at the data server farm at the firm we get our data from. But in any case, it is a phantom high, it never traded anywhere near that high! Our charting programs generally go back and correct small tick errors but this error was so far out of the range, the normal tick filtering mechanism in our charting program didn’t flag it and replace it. It stayed at that high level.

Yet we made our money using that phantom high as one of our pivots. This leads me to point out that you can’t spend your day worrying about the validity of each tick as they unfold, you have to trade what you see and trust you are seeing a representative picture of the market.

How did I find this ‘Phantom Tick’?

I regularly do a type of homework on two of my charting platforms after the market closes. They have the ability to replay price action from a number of days at thirty times the speed that price actually happens in ‘real time’ during the day, so I can practice looking for set ups in ‘sped up’ time over and over in a number of markets whenever I wish. I find this tool very valuable and I am always surprised that more traders don’t use this tool to practice after the markets close.

Several days after this trade was closed, I was doing my replay homework on a charting package that we had NOT used when making the Crude Oil trade. As price unfolded before my eyes, I began to recognize the market and paid strict attention, looking for a change in behavior. Let me show you what I saw on the ‘other’ charting package:

Click on the image to open the full size version!

I marked the range of the ‘Phantom Bar’ in pink to make it easy for you to see. Without the incorrect extreme high that was originally reported, the slope of blue Median Line set was changed dramatically and you can see there were no Energy Points up at the area where we entered our position using this data. There may or may not have been a long entry near the lows of the move right before it began to move higher, but this chart certainly looks completely different than the one we used when making the Crude Oil futures trade.

And yet, trading what we saw in front us, using solid money management, tools that we have mastered, and a solid risk reward ratio, we made a great deal of money per contract.

Let me readjust the data on the second charting package, giving the phantom tick the same high as on the original charting package:

Click on the image to open the full size version!

Here’s the second Charting Package With The ‘Phantom Tick’ added back in. Now you can see the Energy Points are right back where we entered and the two charts match again.

What’s the Bottom Line?

Data is not clean, it is not exact and there is no ‘Holy Grail of Data’. As a professional trader that trades billions of dollars at a time, I do the best I can with the data in front of me. I don’t spend time worrying over each tick. Instead, I trust my methodology, which has been around for nearly 100 years, my surgeon-like money management and my reliance on high risk reward ratios will allow me to make money the majority of the time, even when phantom ticks appear. I do the best with the tools I have. That’s all anyone in any profession can do.

I hope this example of data integrity has been interesting and shown you that sometimes, you can trade on something that never really happened and yet still make money if you’ve mastered your self and your tools.

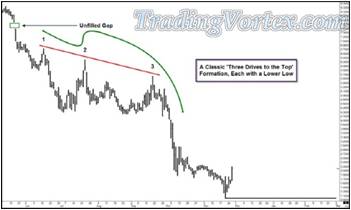

Stalking Major Moves: How To See Signs of Where the Market is Headed?

I have had the privilege of making my living as a professional trader for the last 37 years. I began my career by learning to draw daily bar charts on large sheets of paper and I still update my own hand drawn charts on 27 different markets each afternoon after the market closes; I keep daily, weekly and monthly charts on each of these markets. I find this practice of updating these charts each afternoon invaluable because while updating each one, I am always on the lookout for a change in behavior in that market that will give me an early clue that a change in trend is either imminent or is in the process.

Over the past several years I have been honored to be asked to speak four or five times a year at the Traders Expos and Forex Trading Expo held around the United States. Besides teaching free and paid sessions featuring my own trading methodology and meeting thousands of traders at each of the Expos. Two of the topics that always come up are: Where are interest rates heading and where do I see the Dow going in the next six to 12 months?

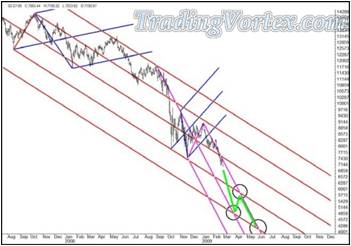

At the September 2008 Forex Expo, I was asked again to predict where I saw the Dow headed for the rest of the year; for reference, the Dow was trading at roughly 11,500. I told the interviewer that I had just updated my long-term Dow chart before getting on the plane yesterday and I felt that the Dow would be below 10,000 in about a month and was headed to 6350 by year’s end. He was surprised at the severity of sell off I was predicting, but I told him the charts I keep by hand had clear signs that a sell off was imminent. Later in the week, there were rumors that Lehman Brothers and AIG might fail and indeed, Lehman Brothers and another firm failed over the weekend and the Dow did indeed accelerate to the down side.

I decided you might find it interesting to see the ‘snap shot’ charts of the Dow I work with, re-created on a computer charting package so that they have the lines, prices and formations that were on my hand drawn charts right before each Traders and Forex Expo since last November, as well as a current chart. Perhaps you will be able to see the signs I look for when stalking changes in behavior and just why my prediction of this massive sell off of the Dow has been so accurate.

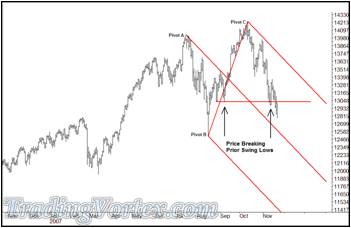

The Dow Jones Daily Bar Chart ahead of the 'November’s Traders Expo' recreated on a computer charting package:

Let’s start with the Dow Jones daily bar chart that was drawn just before last November’s Traders Expo, held in Las Vegas:

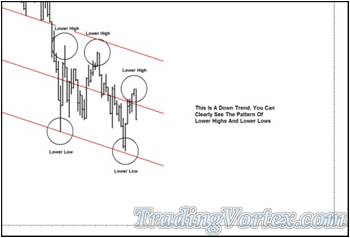

Click on the image to open the full size version!

The Dow made a new high in October of 2007 but then began to sell off its highs. It made one attempt to rally and re-approach the prior high made in October but in early November, price began breaking below prior Swing Lows. It was clear that prices were not only making lower highs and lower lows, but the confirmation of breaking and closing below the prior Swing Lows [which was also a broad area of congestion] was a sign that the sellers were still in control of this market and lower prices were coming.

The Dow was just below 13,000 before my interview last November, and I told the interviewer that I felt the Dow would break the low of the last major recession, 7300, sometime in 2008. Even though there was no credit crisis yet, no bank failures, no bail out packages to lead me to my conclusion, the charts told me all I needed to know: Prices were headed lower and probably quite a bit lower.

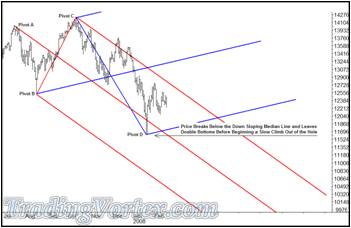

The Dow Jones Daily Bar Chart ahead of the 'February’s Traders Expo' recreated on a computer charting package:

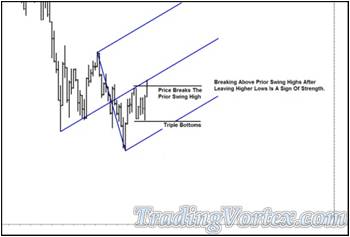

Let’s look at the chart that was drawn just before this past February’s Traders Expo, held in New York City and see what clues it offered about the direction of the Dow and what I said in my interview:

Click on the image to open the full size version!

The Dow spiked lower in mid-January of this year and then began to climb higher: a change in behavior. When it began to make higher highs and higher lows, I added in an up sloping Median Line set. When speaking with the interviewer, I told him The Dow was still well below the Upper Median Line Parallel, drawn off the high at Pivot C and the new up sloping Median Line was only gently positive, so I felt that while the market would consolidate and perhaps rally a bit higher, the chart still looked bearish to me. I still felt we’d see a move to 7300 in the Dow during 2008.

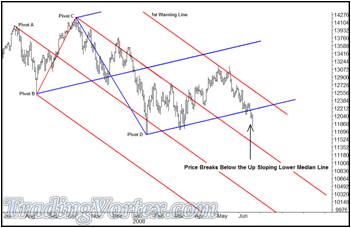

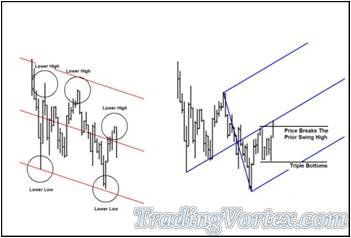

The Dow Jones Daily Bar Chart ahead of the 'June’s Traders Expo' recreated on a computer charting package:

Let’s look at the chart that was drawn just before this past June’s Traders Expo, held in Los Angeles and see what clues it offered about the direction of the Dow and what I said in my interview.

Click on the image to open the full size version!

Between February and mid-May, the Dow did exactly what the prior chart had predicted: It traded gently higher, consolidating in a 1200 point range as it made higher highs and higher lows. The combination of the Dow gently rallying and bars moving to the right each day brought the price of the Dow above the red down sloping Upper Median Line Parallel. Once price closed outside the Upper Parallel, I added a red down sloping First Warning Line to the right of the Upper Parallel, because with roughly 80 percent probability, my statistics show that price will make it to that next line. Note that it worked like a charm! But once price tested the First Warning Line in mid-May, a change in behavior occurred: The Dow basically left double tops just above 13,100 and then turned lower and began making lower highs and lower lows.

More important, in early June, the Dow broke and closed below the blue gently up sloping Lower Median Line that had marked the beginning of the consolidation rally. During my interview, I reiterated that I was extremely concerned that the Dow was in serious trouble and the recent sell off was likely to accelerate. The red down sloping Median Line set was clearly in control and this new change in behavior to lower highs and lower lows, coupled with the close below the up sloping Lower Median Line led me draw in new targets on my hand charts. I now felt we might easily see a move 1000 or more points lower than the prior 7300 major low in the Dow yet this year.

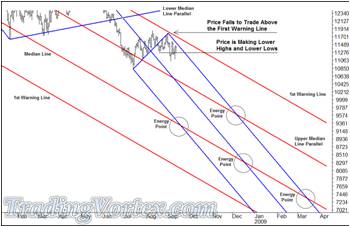

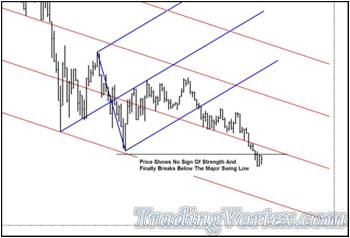

The Dow Jones Daily Bar Chart ahead of the 'September’s Traders Expo' recreated on a computer charting package:

Let’s look at the chart that was drawn just before this past September’s Forex Trading Expo, held in Las Vegas and see what clues it offered about the direction of the Dow and what I said in my interview.

Click on the image to open the full size version!

This is a closer look at the same chart so you can see more of the future potential moves that the Dow may face. The Dow sold off to the 10,850 area, breaking back below the down sloping red Upper Median Line Parallel before beginning a climb higher (another change in behavior). The Dow basically rallied about 800 points but when it approached the down sloping red First Warning Line, it ran out of up side directional energy and began a sell off with lower highs and lower lows (another change in behavior).

I know most of you want to know where the Dow is going, where this will all end and when it is time to start buying stocks again. But remember, I am in the trading business. I don’t predict the weather, I don’t predict where things will start and stop; instead, I look for signs of a change of behavior and work with Median Lines and “Median Lines are leading indicators”. This gives me an edge on the majority of other retail and professional traders, because I am already stalking the markets I trade for turns BEFORE they occur. Then I look for high probability trade entries in those markets to take advantage of the moves the charts tell me are likely to happen.

You can see I have circled a number of areas on the chart above. Those are ‘Energy Points’ or ‘areas of confluence’, where two or more tested lines cross. I am proud to say this is one of the innovate indicators I have brought to the world of trading and I teach traders how to use these areas to greatly improve their trading results in their trading in my seminars and one on one mentoring. Energy Points act as ‘price attractors’, so when I see one on my charts, I automatically draw a circle around the area.

By looking at the circled areas, you can see the various areas where price MAY be drawn to. The red down sloping Median Line set is still ‘calling the tune’ in this market, more than a year after it was drawn. It’s too early yet to know if the new blue down sloping Median Line set will work.

But to me, one thing was clear as I sat down to be interviewed in September: The Dow was about to head MUCH lower. IF price broke below the 10,827 low made in July, the fall would be swift and brutal. And the week before I left for the September Forex Trading Expo, price changed behavior and began making lower highs and lower lows. I told the interviewer that the Dow was in real trouble, the United States was in real economic trouble, and this was before Lehman and AIG failed or were bailed out. The charts were telling me all I needed to know. The Dow was going to test and likely significantly break the prior 7300 lows. And it was looking more and more like the sell off was coming soon.

The Dow Jones Daily Bar Chart ‘Updated on October’ and recreated on a computer charting package:

Let’s look at the chart I updated on October 10, 2008:

Click on the image to open the full size version!

The Dow continued its downside behavior, making lower highs and lower lows. And in the past ten trading days, the ranges have widened and the sell off has intensified. There have been more bailouts, more failures and a package put together by the United States Government and the Dow continues to the down side.

You can see by the Energy Points I circled on the current chart just where the Dow MAY go. There may be a good selling opportunity IF the Dow rallies soon around the 9600-9700 area. The down side targets that are most likely to be meaningful are at a re-test of the 7300 area if price can slow its descent and then congest a bit before falling. There’s another Energy Point at the 6300 area that is also a good candidate to be a price attractor. And obviously, there are areas below the 6300 level that the chart shows as possible targets; in short, the Dow and the United States economy are in dire trouble.

I hate to sound so negative on the United States Economy and our stock market, but we are facing high inflation. In my opinion: inflation is currently running at 17-20 percent and the recent sell off in the U.S. Bond and Note market may be reflecting that, and are on the brink of a 1930’s type depression. Our elected officials do not have a plan, in fact, only solving the inflation problem and then the passing of time will allow the Dow, as well as housing prices, to begin any significant rally, although from significantly lower levels.

Where will the Dow and housing prices be when the bottom is finally in? I am a trader, not a forecaster. I’ll look for a sign of behavior and I’ll be one of the happiest persons in the United States when I see signs that a major bottom has form: BECAUSE I have been so negative for so long. But until our leaders give the economy the medicine, the sickness will continue.

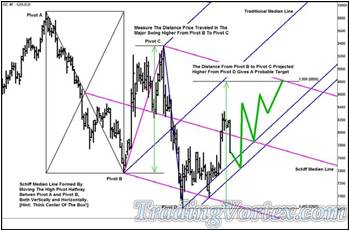

How A Professional Trader Builds a Case For Entering a Trade?

As an educator, one of the best feelings in the world comes when you view a beautiful set of charts put together by one of your long time students that brings together market structure, market context, and a simple yet high probability trade entry set up that plays out profitably once it is framed right. Carl has been in one-on-one mentoring with me for quite some time. His trading has become more and more consistently profitable, but equally important, his ability to read, understand and place current and likely market structure into a cohesive context has really taken his trading to a new level. Let's go through a set of Carl's actual charts that he marked as he began looking at this market, as this market unfolded, as he put together a cohesive trading plan, and as he executed his trading plan live.

This type of record keeping, even in a stream of consciousness form, is immensely helpful when any trader goes back to look through and judge their current thought process. I would highly recommend traders always document their trades; and of course, the more detailed the better.

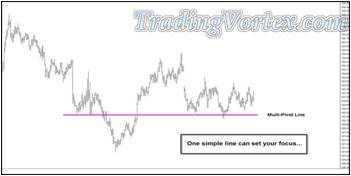

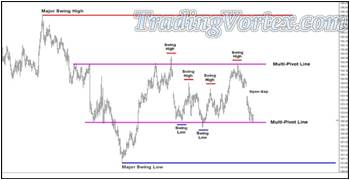

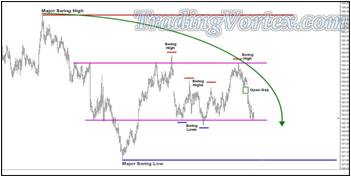

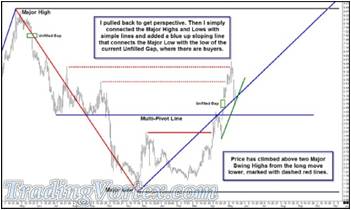

Click on the image to open the full size version!

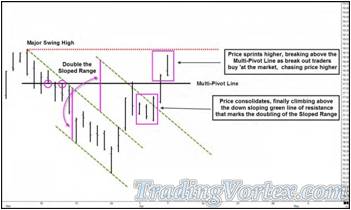

On this chart Carl is beginning to build his Market Map. The upper red horizontal line is a Multi-Pivot Line that cuts through price action, and in a sense, highlights a potential Change in Behavior. You can see that price broke below a major Swing Low, far to the left, at around eighty-nine cents in the Australian dollar but was able to recover from the spike low to retest the multi-pivot line at roughly 0.9070.

When price fails to climb and hold above the Multi-Pivot Line and begins to trade lower, Carl begins to play 'what if'? He draws in a blue down sloping Median Line, using the extreme Swing High of the move for his A pivot and the recent Major Swing Low and Swing High as his B and C Pivot. At this point, Carl is simply working on a Market Map: he's reading the Market Structure, and putting it into context. He is far away from any thoughts of a trade; he is simply drawing out the boundaries of the neighborhood, so to speak, as he becomes familiar with the territory. This is what any good map maker would do when evaluating a new territory.

Click on the image to open the full size version!

Now price breaks below the shelf featuring a minor swing low; note that Carl added a red dashed horizontal line to mark this price action. You can tell by his comments on the chart that this break of the red dashed horizontal line hasn't yet convinced him that a significant, tradable down trend has begun. He is still playing 'what if', though perhaps his Market Map is becoming a little more readable as the price action unfolds.

Click on the image to open the full size version!

Carl zooms in on his current Market Map and adds a set of up sloping lines. He first connects a series of highs and lows with an up sloping yellow line; he then copies the slope of the line and adds a parallel up sloping line off the lowest low connected to his lower horizontal red line. He measures the distance from his lower up sloping line to the yellow up sloping line, and then projects a new up sloping line using the same slope and distance. Note that this simple technique projects forward where price will run out of upside directional energy, the high price makes as it tests the upper red Multi-Pivot line; out of curiosity, he divides the distance between each projected line and his yellow Center Line.

The notes to himself say it all: By dividing the lines into Quartiles, he sees the first dashed Inner Line catches a significant low. But before he gets too excited about one major touch, he notices the upper Inner Line or Upper Quartile, isn't showing where price is running out of upside energy.

These lines are projecting forward some frequency, but they aren't the entire story. It's just another puzzle piece he has put in place while fine tuning his Market Map.

Click on the image to open the full size version!

Price breaks below the prior significant low at the lower inside dashed Quartile. It is now much easier to see that price is cascading lower, leaving Lower Swing Highs and Lower Swing Lows. He marks the last bar as a probable 'Zoom' bar, meaning it ran though the lower Inside Quartile and closed near its low, a sure sign of weakness. The probable path of price is down, towards a test of the red horizontal Multi-Pivot Line.

You may note with interest that Carl has done a great deal of analysis and he hasn't marked or mentioned anything that remotely sounds or looks like a trade idea. One of the practices we teach over and over is to slow down! There have already probably been 100 potential trades if you tried to trade every squiggle since Carl began marking up this chart, but he is both trying to finish his Market Map and also looking for a high probability trade that he personally uses, and so far, while he has done a great job adding Market Structure and then defining the Context of the current market [we often say, 'The market has finally started Rolling now'], he isn't ready to trade.

Click on the image to open the full size version!

Price continues to head lower and is getting close to testing the lower red horizontal Multi-Pivot Line. It's possible there will be large Limit Buy Entry orders at the red Multi-Pivot Line, but price hasn't come down to test it and 'look behind the door' to see if there ARE Whales or large traders looking to buy at that area. And as important, the double bottoms to the left where he began the red Multi-Pivot Line would be forming his buy entry set up AND he'd either have to put his stop below them OR he'd have to use a cash or dollar amount stop. We have shown time again that stop loss orders are much more likely to remain unfilled when hidden behind Market Structure. In one on one mentoring, when a student finally begins relying fully on Market Structure to dictate where their stop and profit orders should be [because the Whales will also have orders at or near those levels], their profitability generally increases nicely, and they marvel how often their stop was missed by two or three ticks or pips.

Carl's exact comment is: 'Can't do it let's hit the layup'; that means he was considering the potential long, a 'fishing expedition' for a long position in a down trend, but the Market Map in front of him tells him if he just remains patient, a solid entry will present itself. Too many traders must trade if they are in front of their screen; if they missed entering the move down, they will 'fish for long trades' as price continues to move lower. Carl is showing wonderful discipline and patience and generally, the market rewards those that trade when they have an edge and stay out of the market when they do not have an edge; Carl is waiting to enter this.

Carl may have been correct in his earlier guess that there were Whales with large Limit Buy Entry orders at or around the red lower Multi-Pivot Line. If you look closely at the last bar on this chart, you will see that price not only tested [or looked behind the door] of the red Multi-Pivot Line, it also closed well above, which generally means there were good Limit Entry Buy orders sitting there, which caused the market to bounce as they began to be executed.

Click on the image to open the full size version!

Does this mean the cascade lower is over and Carl missed his potential trade? Not at all. One bar may tell us a little, and the action after that one bar will tell us a bit more, but at the moment, Carl's Market Map is showing us a cascading downtrend and price is currently testing potential support. To put it simply, it isn't time to trade unless YOU are one of the Whales and have a reason to be buying at or near the level of the red Multi-Pivot Line.

Click on the image to open the full size version!

Carl watches price bounce back from the test of the red Multi-Pivot Line and notes that there probably Whales buying in that area. But again, he had no prior knowledge, in the form of a prior test of this line, to base a decision to attempt a long position. And even though price found buyers in this area, price is still cascading lower, the current market context hasn't changed.

I don't know if Carl pushed his chair back from his desk and looked at this chart from further away [something I do a lot when creating my Market Maps to keep perspective] but look what he wrote: 'this fork is HUGE' [he was referring to the blue down sloping Median Line and its Parallels]. Then he added that the 'direction may be right still but this is a 20 minute chart'. And of course, he echoed my earlier comment with. 'I bet there are multiple trades on the way down'.

What's He Saying Here?

Price has come down quite a ways and yet it is still between the Upper Parallel and the Median Line - there is LOTS of room to trade within this Median Line. Price tested its Upper Parallel but ever since, it has been an orderly cascade lower, right to the area where price may run into potential buyers.

Why Would Whales Be Buying At This Level?

This is a 20 minute chart but yet you can see that even though the immediate current trend is down [price is rolling down, we'd say], the actual earlier uptrend hasn't yet been damaged; the Whales that wanted to get long at lower prices much earlier may still have that same interest! They don't have to chase price higher; and most Whales never chase price, unless they are stopping themselves out of a losing position.

Carl has a fairly well detailed Market Map in front of him and it seems to be working just fine. He is patiently waiting 'in the weeds', reading his Market Map, waiting for an easily recognizable trade before getting involved. If more traders would exhibit this sort of patience, they would find their trading much more profitable. I'll say it again: There will always be another trade! Wait until you see an entry you recognize before getting involved, and even better, trade with the market when it is 'rolling'. Trading just to make a trade is an addiction, much like gambling; if you find yourself doing this often, you are gambling, not trading. Slow down and look for trades that make sense.

Click on the image to open the full size version!

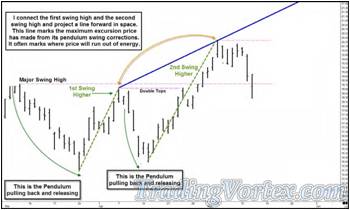

Carl's patience and his Market Map are starting to pay off. If he hurried into a short position and chased price, this bounce may have either hit his Stop Loss order or at least his 'Break Even' Stop order and taken him out of his rhythm, instead, he is looking for a trade entry he recognizes with a quality Stop Loss order that is hidden behind Market Structure and has a good Risk Reward Ratio.

He marked the first Swing High that price has been able to break back above; now he has a quandary: Is this the beginning of a new uptrend or is this the pendulum pulling back into his sell zone, in the current downtrend? How will he tell? He has already built a wonderful Market Map. He also gave you a clue about his intuition: He wasn't willing to try a long entry where Whales MIGHT be hiding their Limit Long Entry orders. Instead, he said he was 'looking for the layup', meaning he wanted to trade with the rolling market.

What About The Whale Limit Buy Orders Below?

They are now a part of his Market Map. They were there the first time price tested that area, so he will have to keep that in the back of his mind if price approaches that area again.

Click on the image to open the full size version!

Now Carl thinks out loud: He marked the Inner Quartile between the blue down sloping Median Line and the Upper Parallel. Price could not hold below this Inner Quartile, so he is considering it the line of Maximum Excursion [remember, it has a downward slope]. Then he asks, how did we zoom above this line when we were briefly below it? Think carefully about the price action near the lows and see if you can imagine what it would take to get price to zoom out of this hole.

As price made new lows, some traders chased price lower, entering or adding short positions at lower and lower levels. And some traders tried to pick bottoms, but were stopped out-but they are still leaning toward holding long positions. When the selling hits the large Limit Buy orders from the Whales, the selling is absorbed and then dries up and both the Whales and the traders that had an interest to be long begin to buy. Soon a rally starts, and price does not have to go too far before those traders that sold 'in the hole' either to establish new short positions or to add to their existing short positions are forced to begin buying, to cover their losing positions or to protect any profit left in their short positions. As Carl said, 'How do we get a zoom? We need traders bailing out of positions!'

Carl's last comment is an important one: By the time price seems to have changed to a minor uptrend, the price action is so sloppy on both sides, he stands aside. One of the keys of Market Context is to be able to instantly assess volatility, as well as Changes in Behavior; this market has become a free for all, and right now, Carl wants no part of it.

Has His Patience Finally Paid Off?

He has the gun cocked; let's see if he is ready to pull the trigger!

Click on the image to open the full size version!

Then 'sitting in the weeds' looks like it may pay off for Carl. Price trades higher, but the price action as it retests the down sloping red Upper Parallel is 'clumping' or struggling; he also notes there is a well known Fib retracement area just above where price is stalling, and there are probably quite a few orders from traders that use Fib tools as their main indicator to sell at that level. If you put this all together and you are Carl, it spells a trade entry signal he recognizes.

Click on the image to open the full size version!

He gets short at the retest of the blue down sloping Upper Parallel after price breaks below the bottom of the clumping bars. His initial Stop Loss order is just above the multiple tops made by the clumping formation.

His Profit Target?

He'd LIKE to get his money out based on the Structure of the Market, just above prior Major lows and at the down sloping blue Median Line.

He took his time and drew a very detailed Market Map. He was extremely patient, waiting to trade until he recognized what looks to be one of his 'layup' patterns, the ones he relies on regularly. He framed out the trade in the context of the current market: This should be the pendulum pulling back to a quality sell area and if so, a Change in Behavior is occurring. Price should now begin breaking prior Swing Lows. Let's see how he manages the trade now.

Click on the image to open the full size version!

You can see that after a handful of bars, price forms a wide range bar, falling all the way to the lower Multi-Pivot Line.

Were There Buyers There This Time Down?

Look at the close, well above the retest of that horizontal line where the Whales were buying before! That's generally a sign of large Limit Buy orders. Traders opened the door, peaked in, and ran back up the hallway, closing the bar quite a bit above the area where they found the orders resting.

By the way, though it isn't marked on this chart, Carl is now working a Break Even Stop Loss. There is no closer structure he can hide behind and price is now testing key support. Should it rocket out of the hole, he has collapsed his risk so he will lose nothing on this trade.

Click on the image to open the full size version!

Now Carl notes that even though there are large orders to buy at the red horizontal Multi-Pivot Line, price is no longer backing away; the buyers are not getting much upward movement. If they don't get upward movement in the next bar or two, they have two choices:

- Pull their Limit Buy orders and let the breakout sellers get short - then buy with both hands and see if they can start a 'wash and rinse' higher and trigger the Stop Loss orders on the new short positions.

- Or if price breaks through their Limit Buy Orders, they can try to flip their position and go with the rolling market.

The next few bars are key here: the Market Context tells Carl the real battle is at hand!

Click on the image to open the full size version!

Did The Whales Pull Their Limit Buy Orders Or Did The Market Simply Roll Over Them?

It's too early to tell, but a 'wash and rinse' would be in the back of my mind. But at this point, Carl has Market Structure on his side and a great entry price, so he is hiding his Stop Profit order well above the action, where any 'wash and rinse' might take him out of his position prematurely.

Price has now zoomed the red horizontal Multi-Pivot Line, as well as the Inner Quartile, the sloped line of Maximum Excursion. Price entered into new territory.

As A Map Maker, What Do You Do? Do You Continue To Drive With No Sign Posts, No Familiar Territory?

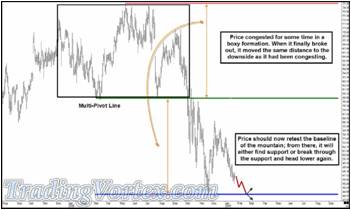

Click on the image to open the full size version!

Carl realizes immediately price is in an uncharted part of his Market Map. He pushes his chair back for perspective and immediately sees a down sloping Multi-Pivot Line that catches major tops to the left and projects it forward - and notices price is testing this Multi-Pivot Line now. His profit target is well below this line and the market is rolling lower.

He has a great price on his entry and now he has both Market Structure and the current trend in his favor. He refused to chase price and instead, waited in the weeds for it to come to him, giving an entry 'close to the bone'. Now he has the luxury to manage the trade as price unfolds in front of him; the smaller normal noise of the market, the squiggles, shouldn't approach his current Stop Profit order.

As Carl says, after a near vertical move, price tends to coil, or congest. He takes the time to update his Market Map further when he sees a new down sloping Multi-Pivot Line above the current action. He is playing 'what if' as he thinks through the current price action and updates his map. He is asking himself: 'What is the probable path of price here?'

Click on the image to open the full size version!

As you watch this unfold, what are you asking yourself? Would you have mapped out the market? Had the patience to wait for a quality trade [remember, I said earlier there probably 100 trades in the wavelets of this market] or would you have chased price and been stopped out several times, like most traders?

Click on the image to open the full size version!

This is where patience really pays off! If you, as a trader, rushes into a position and have a poor or mediocre trade entry price, you need price to give you near immediate gratification. If you are a break out seller and got short below the red horizontal Multi-Pivot Line after it gave way, you have a poor entry price and may even be stopped out by now on this pullback, which is a natural congestion after a near vertical pullback.

Carl was patient and this is a small squiggle - it doesn't bother him at all. As he said, price is probably still going lower, but it will go down at its own pace. And since he framed this trade out beautifully and has great trade location, he has the luxury of watching while price 'plays its cards'. There is no need for him to feel any sense of urgency.

Is this how you trade or do you chase price and then pray the small pullbacks won't stop you out?

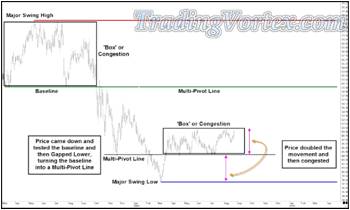

Click on the image to open the full size version!

As he watches price unfold below the red horizontal Multi-Pivot Line, Carl updates his Market Map with a down sloping red Median Line and its Parallels. This red down sloping Lower Parallel has been tested already, so it is probably carrying the frequency of the current price action. Note the confluence or Energy Point where the down sloping Median Line intersects with the red horizontal Multi-Pivot Line - It may come into play.

Click on the image to open the full size version!

Price doesn't make it higher to test the Energy Point; instead it begins to cascade lower. And Carl's red down sloping Median Line and its Parallels seem to be doing the job. Carl's Market Map continues to do an excellent job showing the probable path of price.

Now Carl makes a very important reminder to himself: Price probably needed to rest, so relax and let it do what it needs to do. The ride lower may be slower than some traders would like, but price goes where it wants to go, at its own speed. If you have framed your trade out correctly and gotten in at a quality level, this is the time when you want to make sure you look at your Market Map several times and relax! Price has slowed down but there is no rush! Let it play its hand and don't be in a hurry to move stop profit orders too close to the action [something I see traders do far too often] or even get nervous.

You have a trading plan written down, right? Just relax and follow the plan.

Click on the image to open the full size version!

Carl gets paid well for taking the time to create an extremely accurate Market Map, for having the patience to wait to trade until he saw a high probability entry set up, then framing out a trade based on the current Market Context and Market Structure. Then he followed his plan and because of his wonderful entry level and the accuracy of his Market Map, there was never any reason to be anxious as price cascaded lower.

There is one extremely important piece of wisdom Carl casually puts on this chart: He planned to take profit just above the prior Major Low, at the yellow horizontal line. That's how he framed the original trade and when price filled his Limit Buy order, he comments, 'We got our money, take a break and see what happens next!' He needs to restore the energy and focus he expended on creating this wonderful Market Map, patiently watching and waiting for his 'layup' trade, framing it according to his Market Map and the then current Market Context and then executing his trading plan step by step.

Very few traders start out with a Market Map, many traders don't start out with a trading plan and most don't 'frame' their trade. Instead, they see the market moving and 'find' a way to get in and try to find a profitable way to exit their new position. Compare that type of trading with the choreographed ballet Carl just performed! Many of the traders that are just trying to find entries are also entering new short positions or are adding to short positions because price has just had a one bar zoom below the prior Major Low. But beware the Whales! As Carl noted: 'These moves often end with a big spike as someone pushes price to pick it up lower...'

Try and imagine what Carl is describing while I describe what happens behind the scenes, from a Whale's perspective: As price approaches a prior Major Low, price accelerates. Prior Major Swing Highs and Swing Lows are generally retested if price gets close to them, because traders want to 'look behind the door' and see if there are orders at the prior Major Swing Low or Swing High. Sometimes, Whales simply leave their orders at or in a zone surrounding the prior Major Swing High or Low. But sometimes, they actively 'trade' the area, especially if these Major Swing Highs or Lows are being tested during their time zone and they are 'wide awake', ready to play!

Click on the image to open the full size version!

Carl's comments, 'Notice how all the trapped players from the zoom kept price down'; by this, he means some traders tried to buy where the Whales bought the first time price tested the red horizontal Multi-Pivot Line - and much to their surprise, the Whale or Whales had pulled their orders. It's also possible a Whale decided to flip his position and push price lower, whether to actually get short or to buy back in at a lower level. You can see traders were trapped long, as Carl commented, because there were consistent sellers on every rally once price broke below the prior support at the red horizontal Multi-Pivot Line.

Carl makes a comment that highlights a trick right out of my own 'Whale Trading' tool kit: If you are a Whale and you want to build a large long position, you also don't want everyone else to be long! In fact, you want to wait to begin to buy until the market looks absolutely horrible - or you MAKE the market look absolutely horrible! If you look at the last bar on this chart, it looks like price is going to zero.

No one in their right mind would step in and buy a large amount - unless they had engineered that last bar by tipping price 'off a cliff' so that every Stop Loss Sell order and every trader's Sell Stop Entry order that tries to make a living selling new lows has been executed. The long positions are gone and everyone that is still playing is short - and Carl hits it on the head: 'If a whale wants to buy down below, he'll make sure they can't get out!'

Click on the image to open the full size version!

If I am the Whale in this time zone, I push price that last few bars, then hold out my hands as the stop loss selling begins just below the prior Major Swing Low. And for a small moment in time, it will be raining Australian Dollars, right into my hands. And as I feel the selling begin to slow, as I feel everyone is nice and short and much more comfortable [and remember, price is now below the prior lows, so for that small moment in time, those traders feel they have finally caught up with the market and now the big move must be coming...], I 'pull the string'. They were right; a big move is coming.

Just imagine how excited all of you are when Major Swing Highs and Lows are finally broken! Your heart speeds up and if you are already on board for the move, you aren't thinking about taking profit - You're thinking about the 'Big One' that is just starting to gain momentum...And if you aren't on board, you are so caught up in the moment, you have to find a way to catch a part of this move, because it's broken the Major Swing, so this has to be the beginning of the Big One. Trading Plan? Market Context? Market Structure? Who has time for those things? As Carl says, everyone is shouting, 'Oh My God, they just took out the lows!'

The smart Whale says: Wait, I should let Carl finish his Whale Tale!

Click on the image to open the full size version!

As the selling dries up, the smart Whale calls every market maker he can and buys everything he can; they are happy he called, because they are sitting on huge long positions in a market on its lows. They make the Whale nice prices, nice offers, because they assume the Whale is also calling to sell. The Whale buys more and more and more.

And though price teeters for a bit, suddenly a few of the larger traders figure out what just happened: They aren't long, they are now short at or near the lows and the market has stopped going down.

And when that last wide range bar closes far above the prior Major Swing Low, those few savvy traders get a sick feeling in their stomachs: They've been taken for a ride on a Whale! The market makers were extremely long at or near the lows, and the Whale ate their long positions. The traders that thought the prior Swing Low would hold were stopped out of their long positions - and some of them went short below the prior Major Swing Lows. And of course, the Break Out Traders are short at terrible levels below the prior Major Swing Lows.

One by one, it begins to dawn on all the traders small and big: 'Someone just stole all the longs!'

Click on the image to open the full size version!

Carl says, 'Price cheers'! This formation is formed by the lucky few that recognize a 'wash and rinse' that was just executed extremely well by a very large Whale; and so, they cover their short positions immediately. If a Whale is feeding down here and he is able to control this market this well, the smart players get out of the way.

And the Whale? He HAD to make certain all the long positions were gone and just as important, all the interest in playing from the long side was gone. These plays work best when you can make it look, for a short moment in time, like only a fool would try to step in front of this train! But when the fool engineered the whole move and is able to build his long position while everyone else is getting ready for the big move lower, he doesn't want anyone else to be long.

Can you guess why? You've all seen this before and many of you have been caught in this train wreck and wondered afterwards what hit you...Why would the Whale want to be the only one long, when the market looks so absolutely terrible?

Click on the image to open the full size version!

The last bar on this chart says it all: When price breaks out of the congestion and closes above the range that had built up just above the prior Major Swing Low, every trader suddenly understands. As Carl says, 'Oops!' Remember, Carl was short from a beautiful level and he wasn't greedy. As price approached the prior Major Swing Lows, Carl took his money and then took a walk. That was the area he identified when he framed his trade as an area to logically take his profits. And he didn't jump up or do hand stands. He followed his trading plan.

But most of the market got caught up in the moment and went with it! Now, none of them are long and as price breaks above the top of this range, they have to begin covering their short positions, no matter where they entered. If you look at this chart now, it's clear the prior Major Lows held.

If it isn't clear to you, push your chair back three or four feet back and look again. No wait, let Carl finish it for you!

Click on the image to open the full size version!

'Everything holding the market down before now means nothing and gets zoomed!' says Carl. And he is exactly right. Look closely and you'll see that when the bar breaks above the range just above the prior major Swing Low, the short game is over. And the doorway out is suddenly very small!

The Whale wants to be the only one long because then more traders will have to chase price higher once they recognize the Change in Behavior. Most of them will grumble and moan about being washed and rinsed but their own greed and poor preparation did them in. If you take the time to make a quality Market Map and then wait patiently for your trade, plan and frame it, and then follow the plan, you will be taking your relaxing stroll or getting a drink of green tea when these 'events' take place - unless YOU are the Whale. Then you will be very busy...

I can't thank Carl enough for such a gorgeous example of an actual trade that has so much going for it - and a set of images so many of you should study over and over!

Please consider starting to keep trading plans before you trade. Start making Market Maps and paying attention to Market Structure and Market Context and then stick with your trading plans. Don't get caught up in the moment, chasing price at its extremes. Plan Your Trade and Trade Your Plan!

Remember, you don't have to be a Whale to play along. If you can read market Structure and Context and know how to read the markets like a Whale, you can spot the Whale tracks and trade right along with them!

I hope you found this beautiful set of images interesting and informative. I hope my commentary did Carl's gorgeous Market Map and his wonderful trade justice. And most of all, I hope some of you learned a little about how Whales think and trade and start thinking about how not to be fish food at these critical levels.

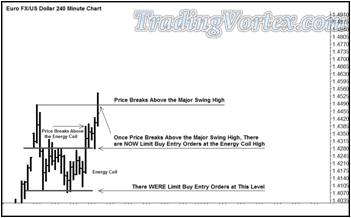

How A Professional E-Mini Trader Finds Great Trades?

We focus on two very important things:

- Our first priority is to help people become consistently profitable traders;

- Our second priority is to teach traders to think about and manage trades like a seasoned professional trader.

I have been a professional trader for forty years and I have been mentoring other professional traders since 1987, and I try to approach every person that approaches me to learn to be a better trader, no matter their level of experience, with those two goals in mind.

It always gives me a great deal of pleasure to watch someone I have been teaching mature into a full time professional trader, and I am proud to say there quite a few traders making a full-time living after either beginning their education with me or after I spent time with them correcting the barriers that had been keeping them from being consistently profitable.

One of the traders I am particularly proud of is Shane Blankenship. Shane spent many years asking questions on my free public forum, then took my Basic Market Maps Seminar and eventually entered one on one Mentoring with me. You can see Shane these days showing his charting and trading skills alongside mine each day, He became such a wonderful chartist and trader that when I recently moved to Arizona, I brought him to help me with the daily live Mid-Day Mentoring sessions. He's been with me six months and become indispensable.

In this article, I am going to show you my re-creations of a week's worth of charting of the E Mini S&Ps Shane showed members live in our Mid-Day sessions, because they tell how a professional approaches the market, prepares and waits for a trade entry, then executes the planned trade flawlessly. I hope you find this set of charts and the story behind them from a recent week in the E Mini S&P futures interesting and informative.

Click on the image to open the full size version!

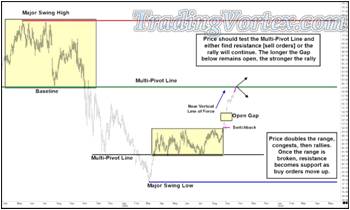

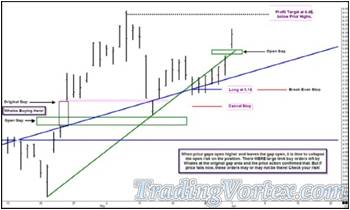

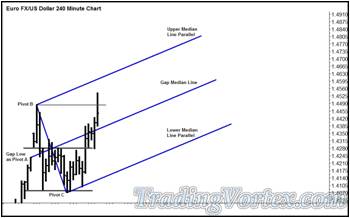

Shane generally charts day only five minute bar charts of the E Mini S&P futures; this means he is often staring at gaps created from the overnight action. Many traders do not like to deal with gaps or have trouble dealing with the meaning of gaps but Shane finds that gaps carry a great deal of information that he can use when 'Mapping' a market.

I tell this story to my students often to encourage them to think 'out of the box': In the early 1980's, one of the largest currency portfolio managers in the world kept three separate sets of data and charts for each Major Area of the world: He would keep data and charts on the New York currency markets, a separate set of data and charts on the Tokyo currency markets and a separate set on the London markets. Odd as it sounds, he would take positions based on the eight hours of the New York markets, positions based on the Tokyo market hours and positions based on the London markets; and yes, at times these positions conflicted. His thinking? Each of these Money Centers had flows that had to be dealt with and his data, charts and positions were based on the flows for each of the three Money Centers.

Back to Shane's chart: The majority of the money that flows through the U.S. stock markets flow when the U.S. 'cash' markets are open, and they are best represented by charting day only session charts. Another way to represent the flow of cash that is popular with larger traders like myself is to chart day only futures that begin at 8:30 am CST and end at 3 pm CST, which mirrors the beginning and end of the New York Stock Exchange's main hours and the majority of the U.S. stock market cash flows as well.

I personally like to chart 13 minute or 39 minute day only charts that begin at 8:30 am CST and end at 3 pm CST, because it gives me a unique look at the U.S. stock market [Yes, I ignore the final 15 minutes of trading of the E Mini S&P futures on these charts, because the cash stock market has already closed]. But these are my re-recreation of Shane's charts.

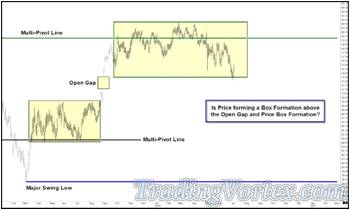

Click on the image to open the full size version!

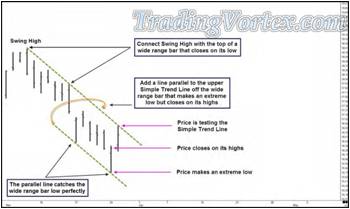

As the week opens, and Shane prepares his charts, you can see that the market left five days of price action above the current price action, on day only charts; this formation, until closed, weighs heavily on the markets and you can see price sold off quite sharply on the following two opens. This chart ends on Friday's close.

Click on the image to open the full size version!

Shane begins by connecting the extremes of the Open Gap, using a Simple down sloping Trend Line.

Click on the image to open the full size version!

Next he looks at the action from the last two days of the prior week and notices an up sloping Simple Trend Line that connects three pivots [a Multi-Pivot Line] and adds that to his chart.

Click on the image to open the full size version!

Now he begins to add potentially important details to his 'Market Map'. First, he makes a copy of the red down sloping Simple Trend Line and transfers it to the morning's high of the same day, and notices it catches the close of the day as well; he leaves this new parallel Simple Trend Line on the chart and measures the distance between the two lines.

Can you guess why he would be interested in the distance between the two down sloping parallel lines?

Click on the image to open the full size version!

Remember, Dr. Andrews and Roger Babson were students of Sir Isaac Newton, who was a well known Mathematician and Physicist. But Newton was also the most well-known alchemist of his times, and although the term 'alchemist' has fallen in stature these days, most well-schooled scientists know that the alchemists of Newton's days, as well as those that proceeded him, laid the ground work for our most powerful scientific principles. Newton's work, in particular, holds many of the keys to modern physics.

His simple Three Laws of Motion spurred the work of Albert Einstein and Stephen Hawkins and continues to spur Physicists around the world more than 200 years after they were written. And most physicists believe his inspiration came from a treatise written at least several thousand years earlier, 'The Emerald Tablet'. Newton's translation of this simple alchemical work is still used as the best and most useful translation. When we look at its most well-known phrase, 'As above, so below', we may be looking at the inspiration for Newton's best known Law of Motion, 'For every Action, there is an Equal and Opposite Reaction'.

I marked where price interacts with these lines to make it easier for you to see why Shane might use these types of projections, as well as to spur you to ponder how these same lines may come into play later.

Shane measured the distance between the parallel down sloping lines and then projected that distance forward [or downward, in the probable path of price]; then he placed a Simple Trend Line with the same slope at that distance. The original red down sloping line was the Center Line, the line that captured the frequency of price, it was a Multi-Pivot Line as well. The Simple Trend Line above captures the first swing or pivot prior to the Center Line; this measures the amount of energy price can carry forward from the Center Line when it 'Reacts'. And of course, by projecting forward a line with the same slope with the same distance below the Center Line, Shane now has a first Reaction Line, where price will have spent an 'Equal and Opposite' amount of energy; as Newton translated: 'As above, so below'.

Click on the image to open the full size version!

Still working on his 'Market Map', Shane performs the same exercise with the up sloping blue Simple Trend Line: he copies the slope of the Simple Trend Line drawn from the low of the Gap Opening and adds a new Simple Trend Line with the same slope to the high of that day; this will serve as his Action Line and the original blue up sloping Simple Trend Line-also a Multi-Pivot Line-acts as the Center Line. Now he simply measures the distance between the two lines and projects it forward [in this case it projects below price, because that is the probable path of price and the natural path of a 'Reaction'] and then adds a new Simple Trend Line at that distance, below the current price structure. This new blue up sloping line will act as the Reaction Line, a measure of where price will have expended its reaction energy off of the Center Line, should it continue lower, and so it is named the 'Reaction Line'. He also adds a second red down sloping Reaction Line [I'll label it R2] in case price continues much lower.

He then adds a horizontal black Simple Trend Line - a Multi-Pivot Line - that connects the high of the Open Gap and a handful of upper pivots. Shane has his Market Map for the upcoming day and is ready to see the opening action, and ready to look for the high probability trade set ups he uses when he trades this market in this time frame if one begins to develop.

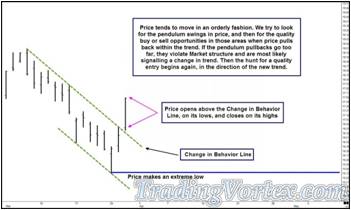

Click on the image to open the full size version!

This chart shows a zoomed in version of Shane's Market Map, along with the first five minute bar of the day session; when this bar closes, it is 8:35 am CST on Monday morning.

I highlighted two particular bars: both wide range bars and both bars that gapped open quite a bit to the down side. Note that in both cases, once the 'morning imbalances' are smoothed out by the market makers in the U.S. stock market, both in some individual stocks and in some large portfolios, the selling dries up. Then the larger traders, the Whales, begin buying out right, pushing the stock indices higher. They are trying to drag mid-sized and smaller retail players into having to chase these markets higher, in case price does indeed go high enough to fill the Open Gap. Look at the close on both extremely wide range bars: Price closes at or near the bar's highs.

But let's look carefully at Shane's Market Map. Remember the blue up sloping Reaction Line he added before the market opened? This up sloped line was based on a Multi-Pivot Line, in this case a Center Line, and the distance from the Center Line to the prior high pivot, which he had used to form the Action Line. As Newton would say, 'As above, so below'. Look at where price turned after the extremely wide range lower gap: Right at Shane's blue up sloping Reaction Line. And that's why he projected that line forward: 'For every action, there is an equal and opposite reaction' and if price sold off on Monday morning, an equal and opposite reaction from the Action Line, projected from the Center Line and its frequency was reflected by the up sloping blue Reaction Line. But that's far from the end of projections contained in Shane's Market Map.

I have been researching and teaching the concept of Lines of Opposing Forces, or Energy Points, for quite some time; I am proud to say it's one addition I have made to Technical Analysis. These Energy Points act as Price Attractors and often serve as areas where price makes a 'Change in Behavior'. I don't use them to anticipate turns in Price; instead I mark them and watch those areas carefully for price to exhibit Changes in Behavior.

In this case, you can see that Shane's red down sloping Second Reaction Line [R2] and his up sloping blue Reaction Line [which are Lines of Opposing Force or Lines with Opposite Slopes] cross at the area that coincides where price does indeed Gap Open, and price shows a Change in Behavior by forming an extremely wide range bar that closes near its highs. In many ways, you can think of these Lines of Opposing Force projecting a sense of a time where Price MAY exhibit a Change in Behavior. And in this case, Price and Time came together, and a Change in Behavior seems to be happening.

Click on the image to open the full size version!

Although Shane's Market Map going into Monday's trading was 'picture perfect', he did not see a high probability trade entry set up that he uses on a regular basis to allow him to enter a trade. The majority of traders feel they must have an open position if they are watching the market; successful professional traders learn they survive and prosper by taking trades that have a successful outcome for them on a consistent basis. There are often days that go by when they 'know' where the market is likely going, but they have no edge, no acceptable money management stop or they don't see a high probability trade entry set up they use and so they don't take a trade.

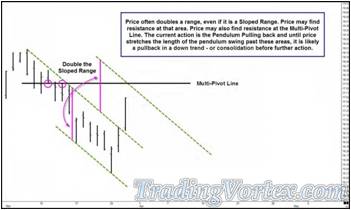

We have seen that when we show live action and 'bar by bar' replay during our Live Mid-Day sessions, mid-sized and retail traders find it at first surprising that we watch without positions even when our Market Maps are so accurate that particular day and then they find it comforting, because it takes some of the pressure off of them to always have a position any time they are in front of the screen watching the market. At the end of Monday, Shane made a single addition to his Market Map from Sunday night: He added a green up sloping Median Line [or pitchfork] to project the probable path of price if Monday's Gap Open Low was indeed a significant low and price continued higher Tuesday.

Click on the image to open the full size version!

Tuesday, Shane took a personal day away from trading and wasn't present at the Live Mid-Day Session. But we all peeked at his Market Map from the night before to see if it had any relevance to Price. You can see that price Gapped Open higher, above the blue up sloping Center Line, above the red down sloping Reaction Line, above the green up sloping Median Line and above the black horizontal Multi-Pivot Line. If you push your chair back and look at the chart, you'll see Price gapped open above an area where these all meet or clump together - and you should consider this a form of Energy Point. This area is a Price Attractor, but you have to watch Price for it to tell you how it is going to react at this Energy Point.

Dr. Andrews, one of my early Mentors and the person that gave us Median Lines and did years and years of research on Action Reaction Lines, taught that if price zoomed through a Median Line, it would come back and test the same Median Line. This is one of the high probability trade entries we teach, after we put in countless thousands of hours of research on various Median Line trade entry set ups. Now that price has gapped or zoomed above the Median Line, you can buy the retest of that Median Line; in this case, there was no acceptable initial stop loss at this point, so I would personally pass on the trade.

But Price has left a poke with a double bottom formation that did recently test this up sloping Median Line. IF price retested the Median Line again within the next three to five bars, I would buy a retest of the Median Line [and in this case, a retest of the Multi-Pivot Line and blue up sloping Center Line as well] with a stop roughly five E Mini S&P ticks below the prior test, which was the low of the day.

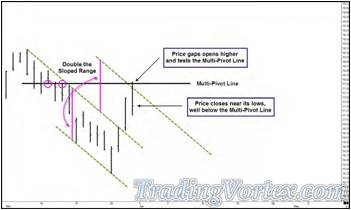

Click on the image to open the full size version!

This is a set of Shane's Market Maps from the week, but I could not resist showing the gorgeous trade opportunity he had prepared for when he did his Market Map the night before; again, he had personal business to take care of, and did not trade this day. But this is how I would have traded his Market Map [I could have written that Shane took this gorgeous trade or that I took it, but again, our focus is to teach people interested in trading how to trade and manage their trades as professional traders - and there are simply days when you have other things to do, or you miss a set up.

There's no shame in that! That's life as it really is! I know showing potential trades we missed or losing trades, as well as teaching people how to set up Market Maps and become consistently profitable traders takes a great deal of emotional pressure off of them; professional traders miss trades. There will always be another trade. And even the best professional traders have losing trades 35 to 40 percent of the time. If you can keep your Risk Reward Ratio high enough, you can make a very good amount of money with a winning percentage approaching fifty percent.

I note the high Risk Reward on the potential trade set up [6.5 to 1] and I also note that when price did turn lower on the day, it was right at the red down sloping Center Line from Shane's Market Map, a line he added to his charts Sunday night.