Unmasking the Enigma of Commodity Trading: A Journey Behind Closed Doors

In the labyrinthine world of global trade, where fortunes are made and lost in the blink of an eye, one industry remains shrouded in mystery – commodity trading. "Behind Closed Doors: Commodity Traders, How It Works" is a compelling documentary that peels back the layers of this enigmatic realm, revealing the intricate mechanisms and powerful players that drive the global economy. Through a riveting exploration of the documentary's insights, we embark on a journey to demystify the art of commodity trading and its far-reaching impacts.

The Foundations of Speculation:

At the heart of commodity trading lies speculation – a practice that has both fueled and plagued markets for centuries. The documentary delves into the core concept of speculation, painting a vivid picture of its role in shaping the ebb and flow of prices. From historical anecdotes of unscrupulous dealings to modern-day instances of strategic buying and selling, viewers gain a nuanced understanding of how speculators capitalize on market trends, often at the expense of vulnerable communities.

The Rise of Modern Traders:

As the documentary unfolds, it introduces us to a cast of modern traders who wield incredible influence over the global market. These larger-than-life figures, known as "chocolate fingers" and "paper traders," operate in an intricate web of financial instruments and derivative products. The narrative navigates through the bustling halls of the Chicago Board of Trade, a legendary hub of agricultural commodities, offering a glimpse into the life of paper traders who navigate the virtual landscape of high-frequency trading and algorithmic bots.

The Advent of Financialization:

The film sheds light on a pivotal turning point – the advent of financialization in commodity markets. The rapid influx of investment funds, banks, and pension funds into the trading arena disrupts traditional dynamics, leading to unprecedented volatility. As financial behemoths enter the stage, the delicate balance between supply, demand, and speculation teeters on the brink, leading to cataclysmic price bubbles and crashes that reverberate across the globe.

Impact on the Ground:

Amid the tumultuous dance of prices and profits, the documentary's narrative intertwines with the lives of real producers – small-scale farmers struggling to navigate an unforgiving landscape. We witness the ripple effects of price fluctuations on these unsung heroes, whose livelihoods hang in the balance. The story uncovers the stark divide between the profit-driven motives of traders and the tangible realities faced by those who till the soil.

Shaping the Future:

The documentary concludes by hinting at a paradigm shift in the world of commodity trading. As producers turn traders and conglomerates flex their muscles, a new chapter emerges. The allure of direct dealing between producers and importers paints a future where traditional intermediaries may face existential challenges. This potential transformation holds promise for increased transparency and fairness in a realm historically plagued by opacity and manipulation.

Conclusion:

"Behind Closed Doors: Commodity Traders, How It Works" is a cinematic voyage that penetrates the veiled corridors of commodity trading. From historical origins to modern complexities, the documentary offers a comprehensive panorama of an industry that weaves itself into the fabric of global economies. As we step out of this exploration, we are left pondering the delicate balance between profit and humanity, and the ever-evolving forces that shape our interconnected world.

Video Key Points:

- Unprecedented Consumption of Raw Materials in 20th Century

- Economic Powers China and India Triggered Demand Surge

- Scramble for Commodities Led to Soaring Prices and 2008 Riots

- China's Demand and Market Dynamics Influence Prices

- Speculation: Artificially Manipulating Markets with Scarcity Perception

- Unveiling Complex and Opaque Commodities Markets and Speculators

- Commodities Traders: Buying, Shipping, and Reselling Merchandise

- Traders Take Calculated Risks as Modern Economic Explorers

- Geneva: Hub for Commodities Trading with 400+ Companies

- Vitol and ABCD Giants Dominating Grain Market

- Glencore: Secretive and Influential with $250B Turnover

- Anonymity and Secrecy Among Business Giants

- Commodities Trading Requires Understanding, Connections, and Insight

- Mark Rich: Legendary and Controversial Oil Industry Figure

- Modern Globetrotting Nature of Commodities Traders

- Predicting Supply and Demand Key to Profit and Loss

- Ethical Practices vs. Corrupt Tendencies in Trading

- Traders Anticipate Crop Yields, Geopolitical Shifts, Weather Patterns

- Single Drought in Russia Led to 30% Surge in Global Wheat Prices

- Negotiating, Analyzing Quality, Financial Arrangements Before Purchase

- Banks Play Crucial Role in Financing High-Stakes Ventures

- Traders Capitalize on High-Value Transactions with Oil Trading

- Financial Crises Can Disrupt Trading Arrangements

- Commodities Traders Balance Risk, Speculation, Ethical Considerations

- Traders' Actions Ripple Across Economies, Impacting Lives

- Enthusiastic Traders Passionate About Products and Global Markets

- Trading is intertwined with speculating since early times, as depicted in D.W. Griffith's film 'A Corner in Wheat' in 1909.

- Speculation is essential for traders, such as in the case of dealing with rice, where foreseeing price fluctuations is crucial.

- Anthony Ward, known as 'Chocolate Finger,' is considered the world's greatest cocoa trader, and his massive cocoa stocks purchase in 2010 affected prices.

- Lack of transparency in the commodities market poses challenges.

- Futures markets, like the Chicago Board of Trade, were created to help traders and producers manage price fluctuations.

- Paper traders, like Tres Knipper, operate in futures markets and use information sources like Twitter.

- Producers and buyers use speculation as a means of ensuring against price fluctuations, but the arrival of large investment institutions has changed the landscape.

- In 2000, after the internet bubble burst, investors turned to commodities markets, leading to soaring prices.

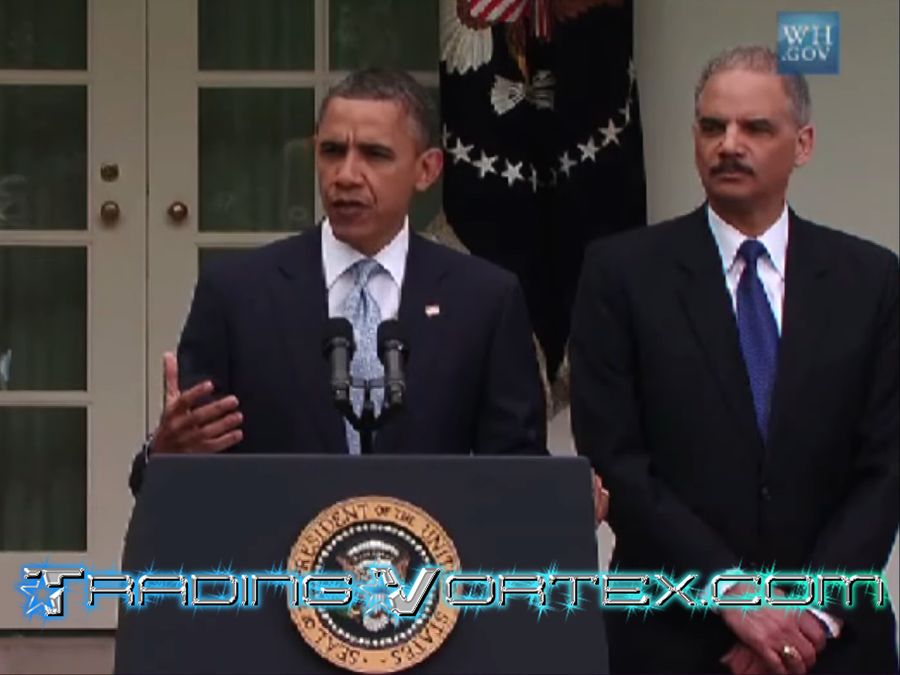

- Barack Obama criticized speculators who artificially manipulate markets for quick profits.

- Computer bots programmed by algorithms have become prevalent in trading, with high-frequency bots causing rapid market shifts.

- Financial bubbles and speculation have far-reaching effects on traders and net importer countries of foodstuffs.

- Small producers often struggle with price volatility and find it challenging to change crops.

- Big producers are becoming traders themselves, leading to a shift in the industry.

- Companies like Cargill have expanded into financial services and speculation.

- Traders play a vital role in keeping the world of commerce moving forward, despite potential market shifts.

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.